The Future of New England’s Energy Market (Video)

Will Renewable Growth in New England lead to Reliability Issues? (Video)

Will ISO-NE change its market to address fuel security? (Video)

Demand Response Programs in New England (Video)

COVID-19’s Impact on the New England Energy Market (Video)

New England Seeks to Balance Renewables and Grid Reliability

Grid Operators in the US deregulated energy markets need only look west to California and the Golden State’s recent barrage of rolling blackouts for a reminder of how an ambitious but unchecked drive to a renewable fuel mix can threaten grid reliability.

California’s charge over the last two decades toward a carbon-free future has led to a flood of solar resources fulfilling the state’s electric demand during the day.

That’s the good news.

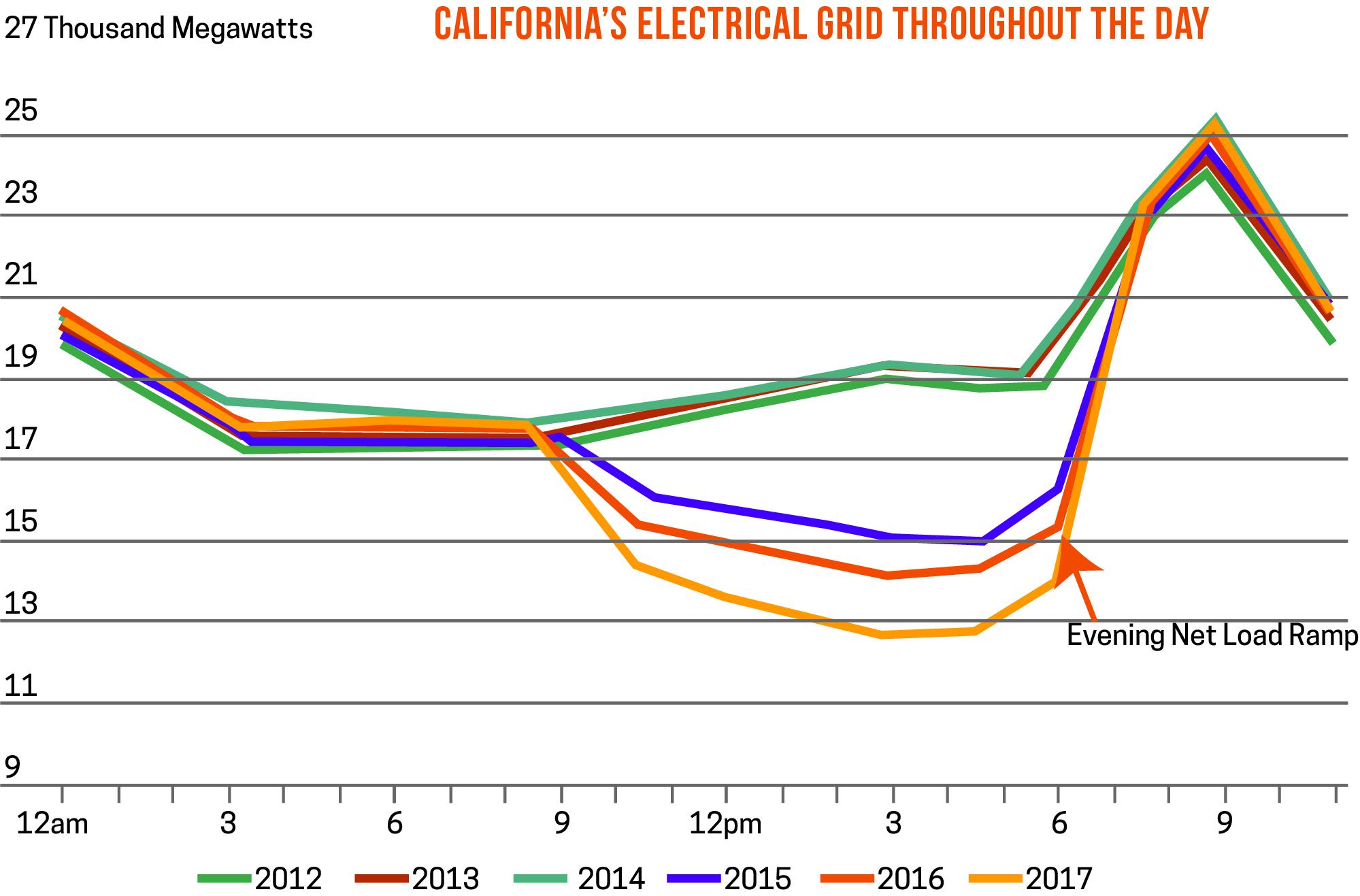

That drive has also led to a phenomenon known in the energy industry as the “duck curve” in the evening when solar resources go offline and demand for electricity ramps to consumption levels that challenge the grid on a daily basis.

That’s the not-so-good news.

The duck curve (named so because the ramp in daily evening demand when graphed on a 24-hour consumption chart resembles the neck of a duck) isn’t new.

For years, in fact, energy markets outside of California have cited the graphed duck’s increasingly bulging belly (indicating a yearly increase in solar resources fulfilling daytime demand) as a case-in-point on how renewable intermittency is both a threat to grid reliability and a challenge for energy markets seeking to evolve their fuel mixes away from traditional fossil fuels.

Energy storage, long hailed as a panacea whose realization was until recently perpetually dismissed as being a few years away, has arrived as an affordable resource, perfectly suited to satisfy progressives’ ambition and grid operators’ reliability concerns.

The question in 2020 and beyond is this: how can energy markets evolve to allow storage resources to participate and help offset the inevitable intermittency of increasingly popular renewable resources such as solar and wind?

New England may have the answer in its lineup of demand response programs at both the ISO and utility levels.

Daily Dispatch Demand Response

New England utilities National Grid, Eversource, and Unitil have introduced a new demand response program called Daily Dispatch.

The program complements the utilities’ highly successful Connected Solutions demand response program and aims to further reduce peaks on their distribution systems.

Daily Dispatch is designed to allow energy storage (batteries, thermal storage) to participate because of the resource’s ability to be dispatched frequently and quickly in response to rising peaks.

The Daily Dispatch program runs during the summer from June through September. The program is intended to be dispatched daily (as the name suggests) with anywhere from 30-60 events each year during the hot months of July and August. Each event is expected to last about two to three hours.

The new program has an attractive incentive of $225-300 per kW per summer. Customers’ compensation will be based on their average curtailment amount for all the events that are called during the summer.

On-Peak Demand Response

On-Peak Demand Response rewards participating organizations for making permanent load reductions.

On-Peak resources are passive, non-dispatchable, and only participate in ISO-NE’s Forward Capacity Market. Eligible behind-the-meter resources include solar, fuel cells, cogeneration systems, combined heat and power systems (CHP), and more.

Passive Demand Response participants offer their reduced electricity consumption into the market during both the summer and winter peak hours.

Potential for Multiple Revenue Streams

New England organizations can participate in multiple demand response programs.

That means that organizations with storage resources are in a prime position to open multiple revenue streams through demand-side energy management.

The New England energy market is evolving toward a fuel mix that features less coal and more renewables.

By introducing ISO and utility level demand response programs that allow for storage participation, the market is aiming to avoid grid reliability woes brought about by resource intermittency.

Organizations with battery storage devices not only have a leg up in the race to superior resilience, but they also have a flexible, dispatchable resource the grid operator and electric utilities recognize is valuable and are willing to handsomely compensate in times when the grid is stressed or electricity prices are high.

Watch CPower’s Jobin Arthungal and Mat Tuttelman explain everything your organization needs to know about the New England energy market in the 2020 State of Demand-Side Energy Management in New England video-on-demand.

State of the 2020 New England Energy Market (Webinar)

Even before the onset of the Covid-19 lockdown, 2020 was expected to be a year of change in New England’s energy market. As the region works its way through the pandemic’s maze, organizations are reexamining their energy management strategies in search of optimization for an increasingly uncertain future.

This webinar is designed to give organizations like yours the demand-side energy management insights you need to make the most of 2020 and beyond in New England.

Topics covered include:

- How ISO-NE is working to address the region’s fuel security issues

- Proposed energy market changes and redesigns

- How renewables are affecting the market

- Energy storage other distributed generation monetization opportunities

- New and existing demand response programs

- And more…

CPower’s New England experts Mat Tuttelman and Jobin Arthungal host this webinar that includes a question and answer session.

SOTM 2020 Webinar Series

CPower Experts Share Insights Into North America’s Energy Markets in 2020 (Webinar)

Watch the latest webinar from CPower and SED

CASPR in New England – Market Minute (Video)

In New England, the second annual Competitive Auction for Sponsored Policy Resources (CASPR) took place in February 2020 for the power delivery year of 2023-24.

CASPR was created to prevent subsidized resources covered by tax credits or state incentives from depressing prices in New England’s forward capacity auctions.

CASPR was designed to allow retiring resources that had secured capacity supply obligations to transfer those obligations to new, subsidized resources that do NOT have an obligation.

The existing resource — from a retiring fossil fuel plant, for example — can then retire and receive a final payment equal to the difference between the (higher) forward capacity auction clearing price and the (lower) secondary auction clearing price.

According to ISO-NE’s published results of the February CASPR auction, zero MWs cleared the auction because there were NO retiring resources leaving the market.

This is the second year in a row the number of renewable resources seeking to ENTER the market have outnumbered the retiring resources seeking to exit the market.

ISO-New England, the region’s grid operator hasn’t committed to fundamentally changing CASPR in 2021, though there has been talk of altering auction as New England seeks to move away from a fuel mix dominated by fossil sources to one that features a greater mix of renewable sources.

For the latest insights on US energy markets by CPower, check back with “The Current” and stay ahead of energy’s demand curve.