Should Texas Connect to the US National Power Grids?

It has been just over a year since Texas suffered rolling blackouts that forced millions of citizens to go without power for days amidst historically freezing temperatures. The unfortunate toll of an estimated $80 to $100 billion in property damage pales when compared to the tragic loss of anywhere between 246 and 702 lives during the storm.

In the year since the blackouts, the topic of ensuring grid reliability within the Lone Star State has been closely examined and hotly debated by Texas’s energy players.

Among the potential solutions is connecting the state’s energy grid–the Texas Interconnection–to the country’s two other power grids–the Eastern Connection, which links suppliers and customers east of the Rockies, and the Western Connection, which links power west of the Rockies.

Currently, Texas relies on a power grid that is separate from the two larger power grids, meaning the state and its grid operator the Electric Reliability Council of Texas (ERCOT) are NOT under the jurisdiction of the Federal Energy Regulatory Commission (FERC), which oversees, among other things, the commerce related to interstate energy transmission.

While remaining autonomous from federal regulation may seem like an altogether core Texan value, the downside of not being connected to surrounding grids is that in the event of a crisis brought about by a lack of available energy resources–as was the case that led to the blackouts in February 2021–Texas can only draw a very limited amount of power from out-of-state sources.

A year removed from the most devastating blackouts in the state’s history, the question facing Texas and its energy players concerning its electric grid and others in the US is…to connect or not to connect?

Would the grid in Texas have failed in February 2021 had it been connected to the rest of the US?

A key advantage of grid connectivity from one state to the next lies in the ability for both states to export and import power as needed based on prevailing conditions.

In a 2021 analysis of five recent severe weather events in the US and their effect on the electrical grid, Michael Goggin of Grid Strategies concluded that had the Texas Interconnection been connected to the rest of the US during Winter Storm Uri, each additional gigawatt of transmission capacity connecting the Texas power grid with neighboring states could have saved nearly $1 billion and kept the heat on in around 200,000 Texas homes.

ERCOT estimates that 1MW of electricity powers about 200 homes during times of peak usage as was the case during the storm. The question during a crisis brought about by extreme regional temperatures is how many MWs (or GWs) of electricity are available to be imported from surrounding states given they are likely affected by similar if not identical extreme temperatures and conditions?

The answer may unfortunately be not enough.

California–a state in which the grid IS connected to surrounding states–found out just how scarce grid resources can be during the west-wide heatwave in August of 2020 that saw scorching temperatures in the triple digits cause spikes in electrical usage throughout the west.

Even though California’s grid connectivity allowed the state to import power resources from surrounding states, there simply weren’t enough available resources to stave off blackouts due to other states in the west dealing with the same heatwave.

One would have to conclude that a winter storm blasting Texas with record low temperatures would contain a spread whose outer bands would also spray Oklahoma or any of the surrounding states, impacting their ability to export significant resources to Texas due to their own electrical demand spiking from citizens trying to keep warm.

Will Texas connect its grid to the rest of the US?

The short answer? It doesn’t look like it. Not anytime soon, anyway.

At the height of the winter storms of this year, Texas Governor Greg Abbott said that Texas has “plenty of power available” and that the state’s power grid was continuing to meet demand.

ERCOT has since reported that there were no significant power outages in Texas during the winter storms this past January and February of 2022, though it’s worth pointing out that this year’s winter was normal compared with last year’s extreme cold.

While the Texas grid may have held strong, this year’s winter did bring tense moments for the grid when natural gas production dropped amidst a cold. The drop, which took place during normal Texas winter weather, has many energy players in Texas questioning whether enough has been done to maintain grid reliability during future extreme weather events.

As for any potential of Texas connecting its grid with the rest of the US, it appears that matter has been settled for at least 2022.

This past February, Public Utilities Commission spokesperson Rich Parsons said in a statement on the future of connecting Texas’s grid to surrounding states, “There are no plans to change the status of the grid.”

State of the Texas Energy Market in 2021

In recent years, Texas’s energy market has been put to the test with shrinking reserve margins, increased electrical demand, and grid-threatening heat waves. The ERCOT grid has held and the market has helped organizations in the Lone Star State earn significant revenue by monetizing distributed energy resources.

ERCOT’S Roadmap to the Future Includes Distributed Energy Resources

On July 13, 2021, ERCOT announced the delivery of its “Roadmap to Improving Grid Reliability,” a 60-item plan that addresses needed improvements to ERCOT’s electric grid with the aim of avoiding future failures like the one experienced this past February when much of the state was left without power and over 200 people died amidst record-setting winter temperatures.

In an official press release announcing the Roadmap’s delivery, ERCOT Board member and Texas Public Utility Chairman claimed the map “puts a clear focus on protecting customers while also ensuring that Texas maintains free-market incentives to bring new generation to the state.”

The notion of the free market is one we at CPower have often discussed in explaining how the ERCOT market differs from others around the country. From its very founding, ERCOT’s energy-only market was designed to let economics, not legislation, drive the action within its marketplace.

In the wake of February’s tragedy–and the harrowing death toll certainly qualifies the event as such–there has been a wealth of debate in Texas and throughout the US on whether ERCOT’s economically driven approach to grid reliability is the best way to avoid future grid failure.

There is one curious item in ERCOT’s 60-item roadmap that is worth pointing out to large consumer and industrial organizations in Texas.

Item 19 concerning the future of distributed generation, energy storage, and demand response speaks to both legislative and financial methods of exacting change on a grid seeking to cross the bridge to energy’s future.

Item 19 of the roadmap reads as follows:

“Eliminate barriers to distributed generation, energy storage, and demand response/ flexibility to allow more resources to participate in the ERCOT market while also maintaining adequate reliability”

With this item, which is “on track” according to the roadmap, we see ERCOT is well on its way to implementing an improvement to its market that is rather similar to the intent of the Federal Energy Regulatory Commission’s Order 2222, which states:

“Order No. 2222 will help usher in the electric grid of the future and promote competition in electric markets by removing the barriers preventing distributed energy resources (DERs) from competing on a level playing field in the organized capacity, energy, and ancillary services markets run by regional grid operators.”

Language like what ERCOT submitted in its roadmap with item 19 wouldn’t raise an eyebrow had it come from any other deregulated US energy market outside of Texas.

That’s because other state and regional energy markets must comply with Order 2222 within FERC’s mandated period of time. ERCOT does not.

Here’s why:

Because its grid is isolated from the surrounding states, ERCOT’s market does not engage in interstate commerce and is therefore not under FERC’s jurisdiction.

Yet ERCOT appears to be on the road to creating a future marketplace that allows its grid to integrate the flexible DERs CPower and other demand-side energy management companies have been touting for years are necessary to maintain a balanced, dependable grid that is evolving to a cleaner future.

Here we have an example of ERCOT agreeing with Federal legislation despite the truth that they are under no legal obligation to do so.

Why?

In the simplest of terms, Order 2222 is a piece of legislation aimed at fostering just and reasonable competition in the wholesale marketplace.

ERCOT’s market is and always has been designed with competition in mind. Look no further than item 19’s language for proof that the future of ERCOT’s grid involves allowing more energy resources to enter the marketplace and compete, not fewer.

ERCOT is expressly stating that it believes more distributed generation, energy storage, and demand response in its marketplace is the best way to ensure a more reliable grid for Texas and more value for its market participants.

As the Supreme Court is fond of saying, it is written. As Texans like to say, let’s get to work and take care of business.

SOTM 2021 Webinar Series

The February 2021 Event in Texas: a breakdown – Market Minute (Video)

What happened during the ERCOT winter event, what’s happened since, and what may happen in the future.

The week before the event we started to see the cold weather forecasts and the projections for high demand for the following week. It was pretty clear that there were going to be demand response events on Monday and Tuesday, so we started to notify our customers of this.

Over the weekend, demand forecasts kept increasing and the situation was looking progressively worse.

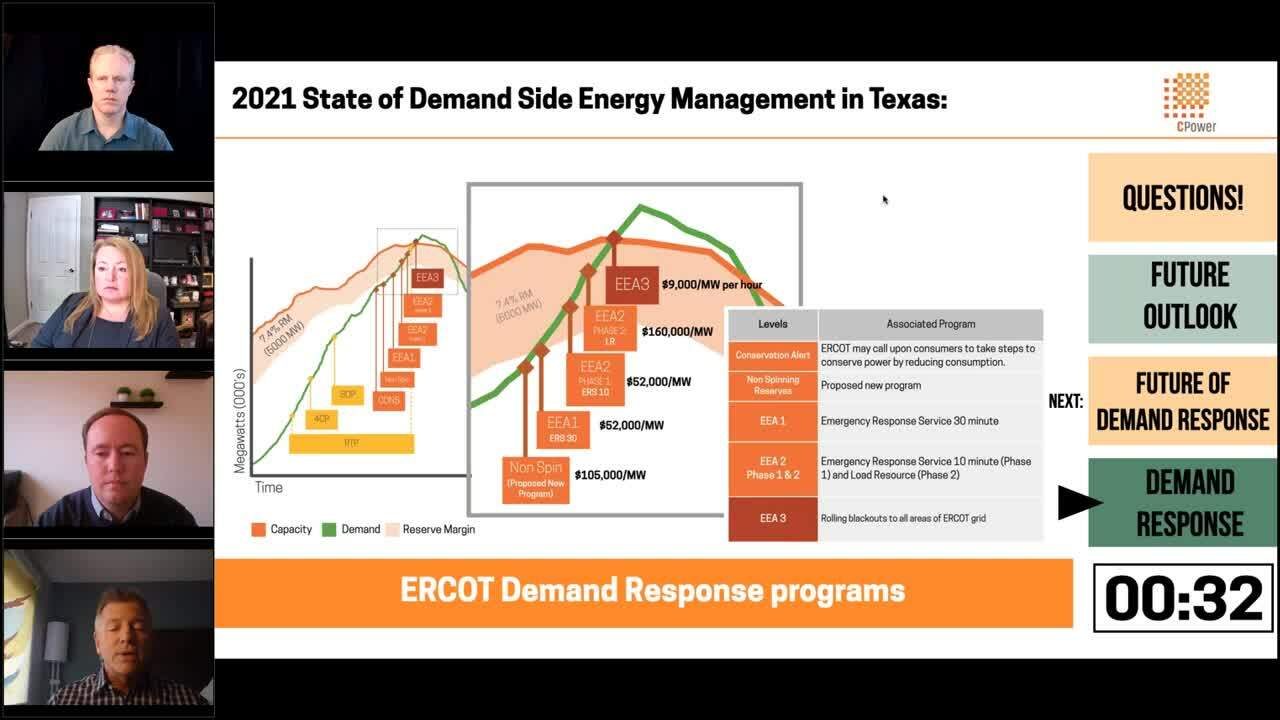

Then, on Monday morning right after midnight, ERCOT called for demand response deployments and our customers responded quickly. ERCOT called both the Emergency Response Service customers and Load Resource customers which are two different demand response programs in ERCOT.

Unfortunately, there were just too many generators that were coming offline due to weather-related issues and this included essentially all types of generators such as natural gas, wind, coal, and nuclear.

You can see on the screen that grid frequency was dropping dramatically on Monday morning and that’s when ERCOT had to call for firm load shed by the utilities.

If they hadn’t done this quick enough, the grid could have gone into uncontrolled blackouts where the grid would have been down for weeks.

The grid was actually 4 minutes away from this and if the frequency had stayed below the line where the red is for four more minutes, other generators would have tripped offline and full blackouts would have occurred which would have taken weeks to recover from.

Thankfully the rolling blackouts worked and frequency recovered and stabilized the grid.

The rolling blackouts stayed in place until Thursday and the emergency was finally lifted from the grid on Friday morning around 10 am.

This next graphic compares the winter event we had in 2011 to the one we just went through.

You can see that every number on the screen is much worse for 2021 than it was in 2011.

First, the projected demand of what the grid would have been if it wasn’t for load shed is 17,000 MW higher this time. It actually would have set an all-time peak demand record, even higher than the summer.

Second, the maximum amount of generation that was offline during the event was 52,000 MW which is almost half of the total generation capacity in ERCOT. In 2011 it was only 14,000 MW. It’s tough to plan for losing almost half of your capacity during a winter storm, so that is something that’s being looked at closely in the market and how we prevent that in the future.

The other important figure here is the load shed which reached 20,000 MW during the event and this lasted for 70 hours compared to 4,000 MW of load shed for 7 hours in 2011.

Clearly, this was unprecedented.

The other note I’ll make is energy prices were at the $9,000 cap during the majority of this event. In the past, prices have only been that high for a couple of hours on summer afternoons. So, the economic fallout from this has been huge and we have seen that with some bankruptcies that have been announced.

Now, since the event has ended, there has been a lot of political fallout as well. The ERCOT CEO has resigned. All 3 PUC commissioners have resigned. Also, many ERCOT board members have resigned.

The legislature is involved as well. There are many bills that have been filed coming out of this event, but it is all still to be determined so it’s difficult to forecast what the end result will be.

We do know there will be changes, but what those changes are we just don’t know yet. A lot of the focus has been on the weatherization of the generation and natural gas supply.

CPower has supported a filing to the PUC by the trade group TAEBA to remove the $50 million cap on ERS. There has been a lot of talk about the benefit that more demand response and DERs could bring to the market and we believe that to be true.

Demand response may not have solved this event, but it certainly can help prevent other issues in the future especially as more wind and solar come on the grid.

This is a situation we’ll be keeping a close eye on at CPower, so check back to the Current for the latest updates.

Demand-Side 2021 Texas: A Commercial and Industrial Guide to Managing Energy this Year (Webinar)

2020 has been a bumpy ride for the Texas energy market, particularly for the oil and gas industry. CPower’s Joe Hayden and Michele Taylor discuss how the commercial sector in Texas is coping with Covid and reveal key strategies for saving on energy with demand management and earning revenue with demand response in the Lone Star State in 2021.

This webinar is designed to give organizations like yours the demand-side energy management insights you need to make the most of 2021 and beyond in Texas.

In this webinar, you will learn how your industry can:

- Prepare for energy management in 2021

- Utilize programs to help you reduce energy cost and generate revenue

- Learn key energy tactics and strategies from others in your industry

- Understand important regulatory news that can impact your energy plan

- Gain insights into energy storage and DERs in your market and industry

Demand-Side 2021 Webinar Series

The Future of Texas’s Energy Market (Video)

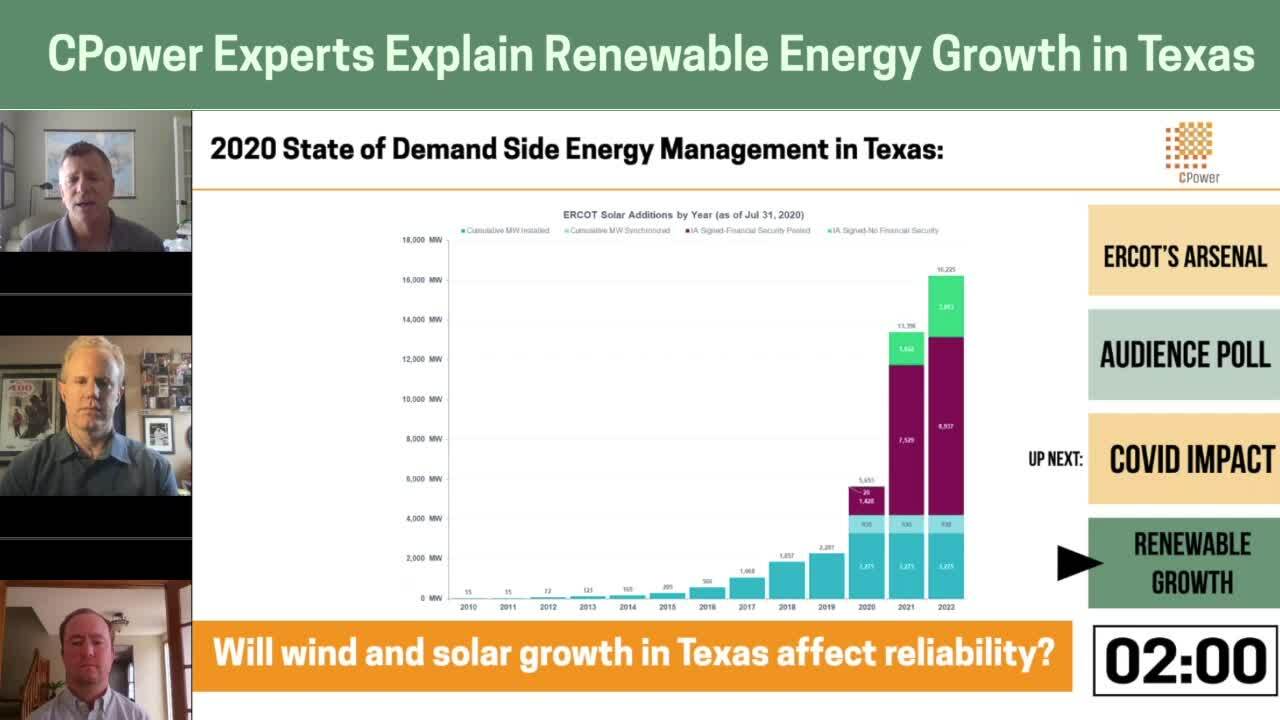

Will Wind and Solar Growth lead to Reliability Issues in Texas? (Video)

Texas’s Unique Energy Market Design (Video)