Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

At CPower, we take pride in our vision of shaping the Customer-Powered Grid®, fostering a flexible, clean, and reliable energy future.

Whether by collaborating with our clients to reduce carbon footprints by 375,000 metric tons of CO2 emissions in a single year or promoting grid sustainability through existing resources, we are proud to know that the work we do is essential in making this vision a reality.

While this is particularly true on Earth Day, our commitment to combating climate change is an ongoing endeavor, not a one-day event or the responsibility of a single individual. Sustainability demands continuous engagement, extending beyond individual efforts, industries or communities.

This year presents a perfect opportunity for individual and collective action because Earth Day has again converged with National Volunteer Week. We have encouraged all our team members at CPower to seize this moment by participating in activities that celebrate and contribute to our shared planet.

Examples of activities and actions we have invited team members to participate in include:

CPower encourages its employees to support their community by taking part in volunteer efforts with community service groups, schools and other such organizations. Each employee gets 16 hours of paid volunteer time annually, which can be used for participating in company-sponsored events or for personal volunteer endeavors. This benefit includes time spent traveling to and from the volunteering location.

Group meet-ups for employees located near each other are great ways to foster company culture and connection. We encourage employees to propose volunteer ideas, invite their co-workers to join them and share their efforts with the whole company via announcements from our HR team.

Also, this year, given the recent event involving the Francis Scott Key Bridge in our hometown, we thought it would be apropos for CPower to donate to a local organization, Blue Water Baltimore. Blue Water Baltimore’s mission is to restore the quality of Baltimore’s rivers, streams, and Harbor to foster a healthy environment, a strong economy and thriving communities.

We appreciate our team members’ continued dedication to sustainability at CPower, for our customers and our planet. Not just on Earth Day, but every day.

Are you interested in joining the CPower team in creating a clean, flexible and dependable energy future? Visit our Careers page to learn about professional opportunities: Careers at CPower.

Heather Merrifield | Analyst, Data Acquisition – Operations

Heather Merrifield is a data acquisition analyst for CPower’s Operations team and a member of the company’s Sustainability Employee Resource Group.

Credit: NASA’s Scientific Visualization Studio

A total solar eclipse will move across North America at more than 1,500 miles per hour on April 8. The moon will totally block the sun along the path in red.

Commercial and industrial energy users can look at the bright side of the upcoming total solar eclipse. They may generate additional revenue by making their distributed energy resources available to keep the lights on in their communities as virtual power plants.

Although grid operators’ extensive preparations should ensure that the grid has enough electricity to avoid capacity shortages during the eclipse on April 8, they may need to quickly bring on new sources of generation, like customer DERs as VPPs, when solar power dims.

Grid operators’ need to carry additional capacity could create opportunities for C&I energy users that make their DERs available through economic markets, reserves programs or other grid services via VPPs. Prices for grid services have the potential to spike, particularly if the weather is clear and solar generation is at or near its potential peak before the eclipse. The sharper the drop in supply that grid operators must cover, the greater the revenue opportunities may be for customers or the need for short term demand response events.

Grid operators as far west as California have been bracing for system challenges, even though the eclipse’s impact will be most acute along the 124-mile-wide path of totality that will slice a swath from Texas to Maine.

The possible impact is much larger than the last time the moon totally obscured the sun, in August 2017. The amount of electricity generated from solar energy has tripled since 2017 with no signs of slowing. In fact, its share of total U.S. electricity generation could almost double over the next two years, rising to 7% in 2025 from 4% in 2023, according to U.S. Energy Information Administration projections.

Although solar generation is an increasingly popular clean energy source, its intermittency demands more grid flexibility, like for managing the California duck curve. State electricity charts typically show a midday decrease in demand when solar supply is highest followed by a spike in demand in the evening when solar supply plunges. Thus, a chart resembles a duck.

Grid flexibility will be especially vital during the upcoming total solar eclipse, which could cause up to six minutes of complete midday darkness in some parts of the country. In a worst-case scenario, solar power would completely cease for those six minutes after generating most of the grid’s electricity on a sunny day. On a chart, it would look like demand dropped from a cliff into a canyon.

Unless demand also drops to zero in that time, grid operators would need to quickly supply electricity from other sources to maintain balance. They would then have to decrease the supply from the new sources just as fast as the eclipse passes, and solar generation ramps up to its previous level. That is, solar generation or its equivalent would need to spring straight up out of the canyon. Hence, the need for flexible generation sources, like C&I customers’ DERs.

Customer DERs like backup generators, battery storage or load curtailment are ideally suited to provide grid operators with the quick-ramping resources they want.

California may be far from the path of totality, but the California Independent System Operator (CAISO) anticipates the eclipse impacting at least some of its 18,500 MW of installed grid-scale solar capacity and 15,770 MW of rooftop solar capacity, nonetheless.

Grid-scale solar generation will decrease by 6,349 MW from the start of the eclipse to maximum impact and increase by 6,718 MW after, according to a CAISO solar eclipse technical bulletin. The net load ramp rate will increase by an average of +115 MW per minute and then decrease by -150 MW per minute.

With a steep climb back to pre-eclipse levels, grid-scale solar resources will use special procedures to limit the solar generation ramp rate during the eclipse return. CAISO will also use battery and hydropower resources to help meet the system’s faster-ramping needs during the eclipse. It will also procure additional operating reserves to help with the expected change in solar generation.

Northwest Texas will be one of the first regions of the U.S. to experience a total eclipse on April 8 as it lies at the beginning of the path of totality. The Electric Reliability Council of Texas (ERCOT) estimates that the state’s solar generation will be impacted from 12:10 p.m. to 5:10 p.m. CDT.

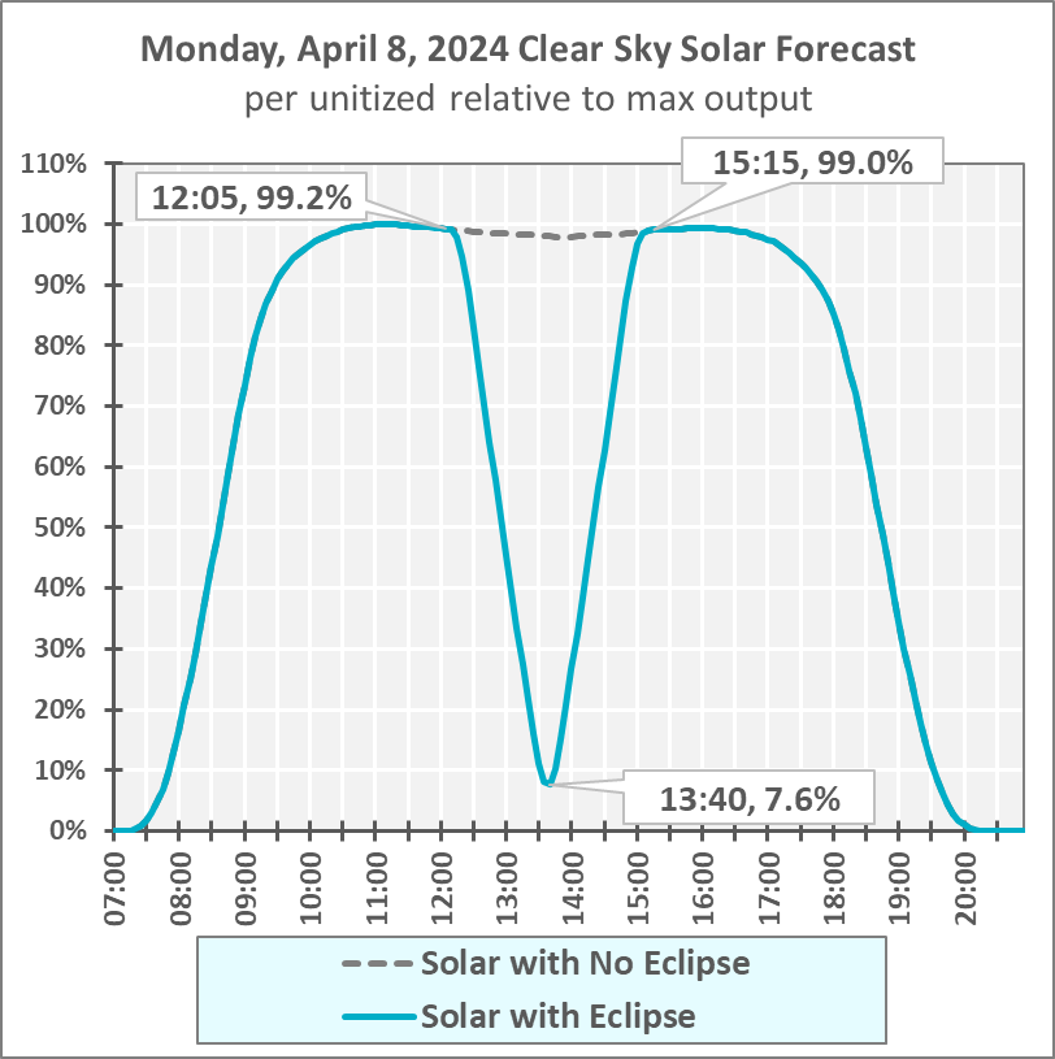

The sun’s coverage of the moon will range from 81% to 99% with the brunt of the eclipse being felt around 1:40 p.m., when solar generation will drop to about 7.6% of its maximum clear sky output, according to an ERCOT resource forecasting and analysis.

ERCOT does not expect any grid reliability concerns during the eclipse because it has been proactively working on forecasting models to reflect reduced solar power production and preparing the grid accordingly. The grid operator says that it will be ready to meet both the down and up solar ramps and to use ancillary services for additional balancing needs.

ISO New England (ISO-NE) is collaborating with local utilities and neighboring grid operators to evaluate the expected conditions and potential impacts of the eclipse. All parts of New England will see at least 80% of the sun blocked by the moon during the peak of the eclipse, according to NASA.

ISO-NE says the eclipse could reduce solar energy production by thousands of megawatts. Most of the region’s solar power comes from small-scale, distributed systems connected directly to retail customers or local utilities and not the regional power system operated by the ISO, the grid operator notes.

“Though not anticipated, ISO system operators have a number of tools available to handle any supply deficits caused by extremely high demand or a sudden loss of other resources,” according to the ISO.

The Midcontinent Independent System Operator, Inc. (MISO) expects balancing and congestion management to be the biggest challenges, based on its experience with the last total solar eclipse in 2017 and a partial eclipse in 2023. MISO manages the flow of high-voltage electricity across 15 states, some of which lie in the path of totality for the upcoming eclipse.

For example, the following cities will experience total obscuration for the estimated durations, MISO notes.

MISO’s eclipse preparations include increasing regulation and short-term reserves and proactively communicating with its markets.

The New York Independent System Operator (NYISO) forecasts a possible reduction of 3,000 MW or more in non-metered, or behind-the-meter (BTM)m generation solar generation at the peak of the eclipse, as well as a temporary loss of up to 110 MW in grid-connected, or front-of-the-meter (FTM), solar generation.

The eclipse is expected to be at its fullest from 3:16 p.m. to 3:29 p.m. EDT with 100% obscuration in Buffalo and Rochester for about 4 minutes apiece. Obscuration is to reach 96% in Albany. Across the state, the partial eclipse is to last about 2 hours and 30 minutes.

Actions to mitigate eclipse impacts could include manual operator intervention and supplemental commitment of fast-responding resources, according to NYISO. The grid operator is also running day ahead market simulations and refining BTM and FTM solar forecasts.

PJM’s eclipse plans include dispatching generation as needed to mitigate solar power losses, including reserve and regulation resources as required. Reserve resources can provide needed backup generation when called upon, while regulation resources can provide energy to help control voltage and frequency on the system, the grid operator notes.

Spanning all or parts of 13 states and the District of Columbia, PJM is preparing for the potential temporary loss of BTM and FTM solar resources during the eclipse. The actual amount of solar generation lost will depend on April 8’s weather. More solar power would be generated, and thus lost, on a sunny day than on a cloudy one, for example.

Even under cloudy skies, PJM is preparing to temporarily lose at least 80–85% of the production from its 8,200 MW of FTM, solar resources, as well as up to 4,800 MW of BTM generation.

The eclipse could highlight how VPPs can help keep the grid balanced during extreme events. Aggregating customer DERs and dispatching them together offer fast, reliable and affordable ways to balance the grid. They also enable energy users with DERs enrolled as VPPs, such as C&I customers, to help the grid by flexing their loads as needed.

In the case of the eclipse, grid operators could cover temporary losses in solar power by tapping VPPs with customer DERs like load curtailment or distributed generation, instead of turning to fossil-fuel peaker plants that could cost more to use and emit more carbon dioxide.

The eclipse also emphasizes the importance of a well-rounded suite of energy assets that can help a C&I customer navigate a range of scenarios, rather than relying on a single type of resource like solar. For example, solar generation can be limited if snow prevents the sun from powering photovoltaic panels or if clouds obscure the sun. However, pairing solar power with battery storage could help a customer weather intermittency.

C&I customers should not limit themselves to using DERs for backup power either. VPP operators such as CPower can maximize the value of customer DERs by monetizing their abilities and optimizing their usage.

As the country’s leading DER Monetization and VPP provider, with 6.7 GW of DER capacity at more than 27,000 sites across the U.S., CPower helps customers earn grid services revenue and reduce energy costs by using their DERs to strengthen the grid when and where reliable, dispatchable resources are needed most.

In the days leading up to the total solar eclipse, CPower will help customers prepare their operations for resiliency while positioning them to earn money from grid services.

Call us at 844-276-9371 or visit CPowerEnergy.com/contact to explore how you can monetize your DERs and earn revenue for helping the grid.

Note: CPower would like everyone preparing for the eclipse to be safe, ensure you have proper solar eclipse sunglasses and to enjoy the show.

Visit the American Astronomical Society’s website for more safety information: How to View a Solar Eclipse Safely | Solar Eclipse Across America (aas.org).

Artificial intelligence is accelerating data center growth and energy needs—and facilities can reduce costs and earn revenue by managing their electricity wisely.

Grid planners have nearly doubled their 5-year load growth forecasts on the back of surging data-center demand. In fact, data centers may account for as much as one-third of the anticipated increase in U.S. electricity demand from 2024 through 2026.

With generative AI driving much of the demand growth and more uses of the technology expected, grid operators will reward data centers for investing in energy efficiency and keeping the grid balanced. Data centers that manage their energy efficiently could benefit as a result.

With data center growth forecast to exceed $150 billion through 2028, grid planners now expect total electricity demand to increase by 4.7% nationwide over the next five years—almost twice as much as the 2.6% lift they previously projected, Grid Strategies found in analyzing utilities’ latest Form 714 filings with the Federal Energy Regulatory Commission (FERC). Data centers typically use 40% of their electricity for computing, another 40% for cooling and 20% for other IT equipment.

Generative AI fuels the data center boom and the associated increase in electricity demand. According to Boston Consulting Group (BCG):

GenAI is expected to account for at least 1% of this increased power usage, mainly because of the electricity-intensive training needed for large GenAI models and the greater electricity needed to service the increasing volume of GenAI queries, BCG noted.

The International Energy Agency (IEA) projects that data centers’ total electricity consumption could almost double from 460 terawatt-hours (TWh) worldwide in 2022 to 1,000 TWh in 2026. That would approximate the electricity consumption of Japan, and developing a large country’s worth of generation, transmission and distribution capacity would be impractical.

Data center growth has brought challenges for grid operators. For example, grid operator PJM has warned that “unprecedented data center load growth” in certain areas of its service footprint could cause “all remnant capacity on the transmission system” to be used.

Northern Virginia is the epicenter for PJM’s regional challenges as well as data-center issues more broadly. Building on federal investments in fiber optics and industry incentives, Virginia has become the world’s largest data center market, with more than 35% (~150) of all known hyperscale data centers (more than 40MW of capacity) worldwide, according to the Virginia Economic Development Partnership.

Virginia’s data center market is growing so rapidly that the northern part of the state needs several large nuclear power plants worth of capacity to serve all the data centers in development. With growth intensifying and challenges mounting, data centers in Virginia, PJM and elsewhere must be flexible to meet emerging capacity constraints.

Improving energy efficiency and maximizing the value of distributed energy resources (DERs) is increasingly important to data centers and the grid operators in the markets they serve. For example, although hyperscale data centers, which are hosted by cloud services providers like Amazon, Google and Microsoft, keep using more electricity, they often offset demand increases by investing in energy-efficient equipment and improving supporting systems such as HVAC and lighting.

With large power usage, comes large potential savings through energy efficiency. Furthermore, data centers in PJM and the Midcontinent Independent System Operator, Inc. (MISO) market region may also qualify for energy efficiency incentives that reward facilities for permanently reducing demand. These incentives are available to facilities in data-center hubs such as Virginia, Chicago and Ohio.

In addition to reducing energy costs by improving efficiency, qualified data centers can earn revenue without interrupting operations. There is no risk or extra cost for qualifying for energy efficiency incentives either.

For example, CPower’s process of qualifying data centers for energy efficiency incentives is simple.

Given that energy efficiency opportunities evolve as the industry changes and power needs shift, working with a partner like CPower can help a data center capitalize on chances to save money and reap incentives as they emerge.

Leveraging the flexibility of DERs like emergency generators, batteries and solar generation is also critical for data centers. The grid’s growing need for flexibility makes DERs increasingly valuable for grid services, thereby allowing data centers to make the most of their resources and maximize their value.

With excess generator capacity meant to keep facilities up and always running, data centers are optimally positioned to earn revenue by quickly curtailing loads in demand response programs. When properly automated, data centers can provide near real-time ancillary services that help keep the grid balanced as well.

Data centers also provide grid flexibility and drive the renewable energy transition by deploying grid-scale, carbon-free energy. Furthermore, as data centers look towards future growth, efficiency and sustainability, they can join virtual power plants (VPPs) to service their local communities and support the grid by optimizing DERs.

As AI accelerates data-center growth and electricity demand, data centers can reduce costs, earn revenue and help the grid by improving energy efficiency and maximizing the value of DERS.

Call us at 844-276-9371 or visit CPowerEnergy.com/contact to explore how you can monetize your data center’s energy efficiency and resources to earn revenue for helping the grid.

Nate Soles

As CPower’s Vice President of National Accounts, Nate manages dozens of data center clients and strategies across North America.

The energy transition is one of the most complex undertakings in human history, but one thing is clear — the grid of the future will be cleaner, more decentralized and more flexible.

This vision has been coming into focus for several years now, as price declines and unprecedented public and private investment in solar, storage, electric vehicles and other distributed energy resources have enabled exponential adoption curves. And most signs suggest that the trajectory will continue.

This will entail a monumental change in the physicality of the grid and how customers interact with it. More and more customers generate or store more of their energy instead of buying it from the grid. Also, utilities and grid operators must balance increasing demand growth, even as extreme weather events become more frequent.

CPower has prepared for this moment since its start in 2014. Founded with a focus on legacy demand response, CPower has always sat at the intersection of customers and the grid. As the use and capabilities of DERs have expanded over time, our leadership in demand response has made us a trusted resource for helping customers, utilities and grid operators navigate the new opportunities that DERs provide.

Our more recent emphasis on virtual power plants may come off as a pivot but it’s just a matter of semantics. The industry itself hasn’t coalesced around the term “VPP” until recently and even now some debate remains around how VPPs are defined.

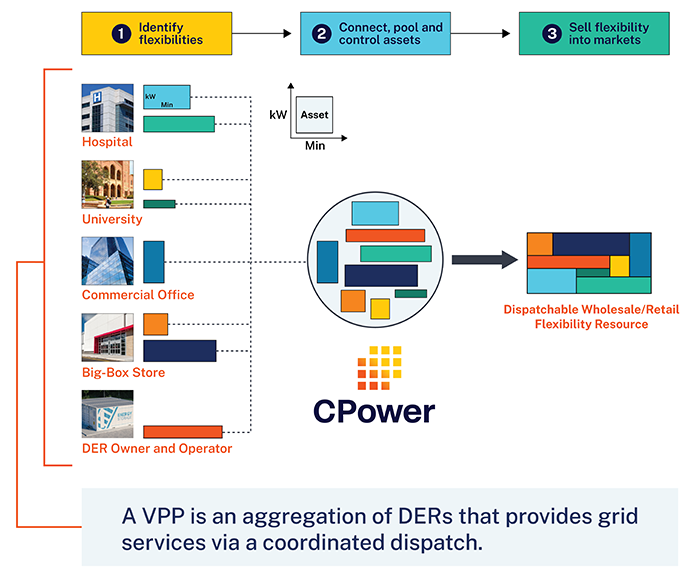

However, there is a clear throughline from the demand response programs that CPower has always offered to VPPs, which are aggregations of DERs that provide grid services via coordinated dispatch. Regardless of how you define VPPs, CPower has been a leader in the space since long before the industry widely adopted the term. We have been aggregating customer assets and dispatching them to help the grid for years.

The importance of our position between energy users and the grid has grown alongside the increasing adoption of DERs. We aim to distill the mind-boggling complexity of the grid and energy markets so that everyone from facility managers to asset portfolio managers can recognize the full potential of their DERs through a VPP.

The growing embrace of the VPP — both the term and the concept — makes that work easier. This embrace is exemplified by the Department of Energy’s push to triple VPP deployments by 2030, which dovetailed with the launch of industry coalitions like the VP3 partnership.

We also felt it was important for CPower to go all-in on VPPs because — given our primary focus on commercial and industrial energy users — we’re in a good position to paint an accurate picture of their potential. For instance, many think of them only in terms of residential assets, but commercial and industrial DERs are the heavy hitters in terms of benefits that VPPs can provide to the grid — both now and into the future.

As a longstanding leader in the evolving VPP industry, we are well-poised to help turn the potential of VPPs into reality. We are helping regulatory stakeholders understand how to fit VPPs into existing regulatory models, leveraging AI to make hourly DER optimization across multiple markets and programs a breeze and demonstrating the impact of VPPs in maintaining reliability when it matters most.

We have also convened industry stakeholders to tackle the top issues and trends in VPPs and the energy transition, including leaders from the DOE, DER providers and commercial and industrial energy users. In doing so, we have paved the way for a better tomorrow by turning knowledge into action.

As one of the first companies to monetize DERs — and with more than a decade of experience aggregating and managing customer assets — CPower is the connective tissue that our energy system needs to scale VPPs and realize our clean energy and reliability goals.

Every day, in everything we do, we enable the larger, more decentralized and more flexible grid of the future. The vision is increasingly clear — and VPPs are bringing it into focus.

Michael Smith

Michael Smith is a visionary and innovative leader who brings more than 25 years of leadership experience in the energy industry to CPower as its CEO. Michael joined CPower from ForeFront Power, where he was the CEO of the company’s North American solar and energy storage business, responsible for strategy and all business areas across the U.S. and Mexico.

Prior, Michael served as Senior Vice President, Distributed Energy, at Constellation, the retail energy subsidiary of Exelon Corp., where he was responsible for Constellation’s distributed solar, energy efficiency, and energy asset operations businesses across the U.S. He also served as Vice President, Innovation and Strategy Development, for Exelon Generation, and led Constellation Technology Ventures, Exelon’s venture investing organization. Earlier, Michael was Vice President and Assistant General Counsel for Enron Energy Services and a trial lawyer at Bricker & Eckler, LLP.

The Super Bowl has been described in many ways, primarily according to one’s opinion of the National Football League’s annual championship game.

Grand. Spectacular. Hyped. Excessive.

And, just when you think you have heard them all, we humbly add another description. At CPower, we see the Super Bowl as: “A lesson in the electric grid’s need for championship-defense-like flexibility, and the supportive might of the Customer-Powered Grid®.” Rolls right off the tongue, doesn’t it?

All joking aside, Super Bowl Sunday is a microcosm of macro energy trends. That is: Our power grid needs more flexibility to balance supply and demand, and customer-sided resources, aggregated into Virtual Power Plants (VPPs) can help.

In recent years, PJM, the nation’s largest grid operator, has published blog posts detailing the ebbs and flows of electricity demand on Super Bowl Sunday and PJM’s management of those shifts. Its most recent post about how the Super Bowl plays into electricity use notes, “ On the day of the Super Bowl and every day, PJM is constantly forecasting customers’ needs. After weather and historical usage comparisons, human behavior is the biggest factor in this equation.”

PJM goes on to explain that “like any other Sunday in February,” electricity usage gradually increases as people begin the day before plateauing at lunchtime. Demand ramps up again in the late afternoon as people finish chores and cooking before the game, then dips after the game starts.

Although the game is regularly one of the most watched TV events, it also is “mostly about collective watching,” Popular Science noted in an article about how we may not use more electricity than usual on Super Bowl Sunday.

So, while you may think that electricity would surge during the game as more people tune in, in fact, it drops as friends and family gather to watch the game together and—glued to their couches and barstools–keep their refrigerators shut and other more energy-intensive devices off. Think more people around fewer TVs.

Enter grid flexibility.

Analyses of Super Bowl Sunday and electricity demand have found somewhat predictable patterns like those that PJM points to, with enough variability to keep grid operators on their toes. This combination of predictable and unpredictable variability in power use underscores why flexibility is only becoming more critical to support how we work and play.

Flexibility refers to the grid’s ability to maintain balance in uncertain conditions through rapid adjustments in supply and demand, as in unexpected, extreme weather that may force power plants offline or more-predictable behavioral changes—like the daily commute, or a big football game.

These rapid changes are challenging because if power supply and demand are unequal, the resulting imbalance could cause brownouts or blackouts. Or, put more simply: the lights go off.

Super Bowl Sunday or not, balancing the grid is increasingly hard because electric demand—from EVs, new industrial and computing loads and heat pumps—is expected to rapidly rise, just as aging, primarily fossil fuel plants are reaching their end-of-life and being replaced by intermittent renewable supply like wind and solar. Grid operators need flexible resources that can ramp up quickly to meet these changing needs.

Grid flexibility will continue to come in several forms; but distributed, demand-side solutions—dubbed DERs (distributed energy resources) and VPPs—are key to a smooth energy transition. In aggregating customer DERs and dispatching them together, VPPs offer a path to a clean, flexible and dependable energy future.

That future is not necessarily far off either. One could imagine that the variability of customer needs on Superbowl Sunday could soon be further balanced and smoothed by DERs like smart appliances and EVs that take a timeout for the busy pre-game prep, but run the hurry-up during the grid’s in-game lull— invisibly optimizing grid use to deliver more reliable, more affordable and clean energy for all.

As the nation’s largest DER monetization and VPP operator, CPower is creating the Customer-Powered Grid® that will enable a flexible, clean and dependable energy future. Call us at 844-276-9371 or visit CPowerEnergy.com/contact to learn how we can help you most effectively invest in DERs and participate in VPPs to support sustainability, improve grid reliability and increase energy resiliency.

Mathew Sachs

Senior Vice President, Strategy & Business Development

Over the last 15 years, Mathew has developed a proven track record of building cleantech businesses through investment, partnership, and organic sales growth. He served with National Grid Ventures as Vice President for Distributed Energy, and has led originations for KRoad DG, a private equity platform focused on energy; Yingli Green Energy as Vice President, Corporate Development; Vice President, Sales & Commercial Operations; and Director, Business Development. Mathew graduated With Distinction from Cornell University’s Johnson Graduate School of Management Master of Business Administration. He graduated Magna Cum Laude from SUNY Buffalo with a B.S. in Mechanical Engineering

Energy industry stakeholders recently convened at CPower’s GridFuture conference to pave the way for a better tomorrow for generations to come.

Path-blazing customers and partners, government officials and executives from companies accelerating the trajectory of the energy transition explored ways to create a clean, flexible and dependable energy future with distributed energy resources and virtual power plants.

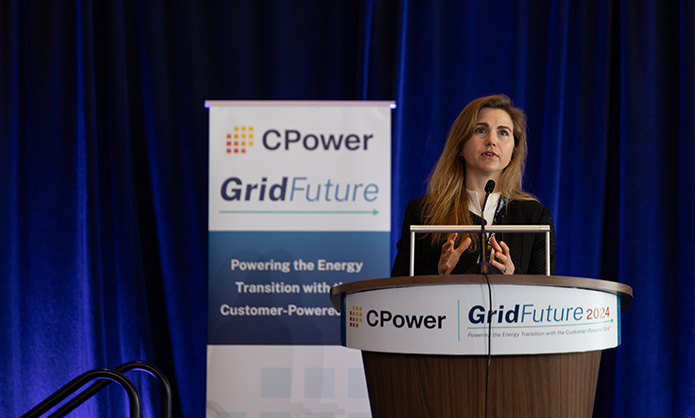

“Our goal with this event is to serve as a catalyst for progress, fostering an environment where ideas converge, partnerships are forged and knowledge is turned into action. As far as the energy transition is concerned, collaboration will be the driving force behind success,” CPower CEO Michael Smith said in opening remarks at the MGM National Harbor just outside of Washington, D.C. on Jan 23.

GridFuture participants collaborated across a mix of meetings, panel discussions and presentations over two days. Here are three key takeaways.

Merely responding to grid disruption is no longer sufficient because our existing grid infrastructure will not carry us into a clean energy future, warned a panel of industry CEOs.

The grid needs more flexibility to balance supply and demand as traditional “peaking” generators retire, renewable generation DERs increase, load from artificial intelligence technology soars, electrification expands and extreme weather events multiply.

Additionally, an estimated 1,250 GW of “unbuilt” clean energy is tied up in regulatory queues awaiting approval to be connected to the grid, which is an amount of capacity roughly equivalent to every generator currently in operation.

What’s more, when electricity demand on the grid is high, utilities and grid operators turn on peaker plants to meet demand. These centralized generators rely on large, remotely located power plants connected by transmission lines that may be susceptible to disruptions from extreme weather, cybersecurity and equipment issues. Therefore, they may not be available during peak times.

Ultimately, LS Power CEO Paul Segal said, “Our grid has become less reliable exactly when we need it to be more reliable than ever.”

Credit: Jon Armstrong

U.S. Department of Energy Loan Programs Office Engagement Officer Jen Downing discusses the future of VPPs.

In aggregating customer DERs and dispatching them together, VPPs offer fast, reliable and affordable ways to balance the grid. “[VPP] technology is a solution that is real today and that will redefine how we generate, distribute, and consume electricity. The benefits to energy users, our communities and our planet will only be more enhanced as we continue in scale,” Smith said.

Smith likened the potential of VPPs to the values of networks in telecommunications. According to Metcalfe’s Law, a network grows more valuable as its connections increase, Smith noted.

“The number of DERs that could be used in VPPs is projected to grow by 15 times over between now and 2035. This will create tremendous value and opportunity both for the grid and energy users,” Smith said.

Tripling current VPP scale by 2030 could address 10-20% of peak load nationally while saving $10 billion per year in grid spending, said Jen Downing, E at the U.S. Department of Energy (DOE) Loan Programs Office, who detailed the value and opportunity that VPPs presents in a keynote address at GridFuture.

Pulling from the DOE’s Pathways to Commercial Liftoff for Virtual Power Plants report, Downing explained how VPPs provide resource adequacy at a low cost while building, reducing emissions, alleviating transmission and distribution congestion and empowering communities.

Credit: Jon Armstrong

Quinn Laudenslager of Energy Toolbase, left, and Metal Technolgies’ Nick Heiny shared examples of how their companies help the grid.

Large energy users with DERs enrolled in VPPs, such as commercial and industrial customers, know that they can help the grid by flexing their loads as needed.

“Flexibility can be minimally disruptive, like participating in a synchronized reserves program, or a major disruption like an emergency demand response event,” said Nick Heiny, vice president of Administration and General Counsel for Metal Technologies, an Indiana-based metal casting company with five foundries and two machining centers in the US and Mexico.

Heiny joined Quinn Laudenslager, vice president of Product for Energy Toolbase, for a CPower customer panel discussing what “flexibility” means on the demand-side and how energy users can use their flexible DERs to address resilience, reliability, sustainability or other business goals.

“There’s always a balance between operating and curtailment, and large energy users need to be mindful of their loads,” Heiny said. Thus, Metal Technologies uses CPower’s EnerWise® Site Optimization to maximize grid revenue and on-bill savings while minimizing disruptions.

“Flexibility also lowers our effective cost per kWh, which allows us to compete with overseas competitors that are adding significant amounts of inexpensive coal generation,” Heiny said.

The communities that surround Metal Technologies’ plants view the company as a good neighbor as well. Commercial and industrial energy users like Metal Technologies reduce carbon emissions when they curtail their loads, Heiny noted. Therefore, they can help their communities while benefiting financially.

Recognizing their contributions to decarbonization, grid flexibility and industry innovations, CPower honored Metal Technologies, Energy Toolbase and other customers and partners at its Customer-Powered Grid® Awards during GridFuture.

Check The Current again soon for more from the Customer-Powered Grid Awards and additional recaps and videos from GridFuture.

Join us on the journey to the Customer-Powered Grid—and the flexible, clean and dependable energy future that it will enable. Call us at 844-276-9371 or visit CPowerEnergy.com/contact to learn how we can help you most effectively invest in DERs and participate in VPPs to support sustainability, improve grid reliability and increase energy resiliency.

Glenn Bogarde

Since becoming CPower’s Senior Vice President of Sales, Marketing and Customer Experience, Glenn has led the company’s sales team on a nationwide mission to help customers get the most from their DER monetization participation. Glenn brings to CPower more than 20 years of sales experience in the enterprise software and energy industries.

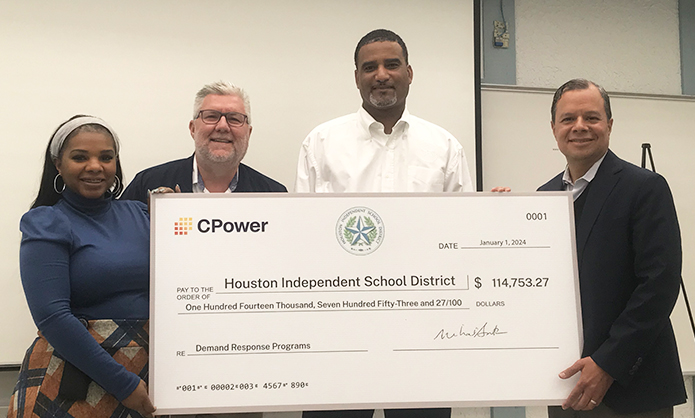

Two large Texas energy users recently shared how much revenue they have earned for improving grid reliability. In separate public events, CPower recently presented San Jacinto College and the Houston Independent School District (HISD) with more than $160,000 in demand response revenue.

“HISD and San Jacinto College exemplify how schools and educational institutions of all levels can make money while keeping the lights on for their communities by reducing loads when demand peaks on the grid,” said James Vasquez, Account Executive, Texas, for CPower.

Both customers participate in Texas grid services programs available through the state’s grid operator, Electric Reliability Council of Texas (ERCOT). HISD and San Jacinto College’s most recent earnings came from ERCOT’s Emergency Response Services (ESR) program, which pays customers for being available to curtail their electricity loads within 10 or 30 minutes.

CPower Account Executive James Vasquez, far left, presents a “big check” to representatives of San Jacinto College.

San Jacinto College received a “big check” for $48,000 for the ERS 2023 Summer Season. The college has five campuses in metropolitan Houston and has earned a total of $434,000 since it enrolled in demand response in February 2016.

The college began working with CPower in late 2022, after a turnover in key facility personnel, Vasquez said. At the time, the college was enrolled for 400 kW between two buildings. After several discussions, including a site visit by a CPower engineer, the college increased its demand response participation by 2,600 kW across nine more buildings.

Depending on the season, San Jacinto College now has 2-3 MW enrolled in demand response. Currently, it is enrolled in the ERS Winter Season (December 2023-March 2024) with a projected revenue payout of $75,000.

From left: Stephanie Walker, HISD; Jeffrey Norman, CPower; Kirby Williams, HISD; and James Vasquez, CPower

CPower presented Houston Independent School District with a “big check” for $114,753, which reflected its combined earnings from enrollment in CenterPoint Energy and ERS Summer Season (June-September) demand response programs. “We were told that this check represented the salaries for two teachers—plus more,” Vasquez said.

With more than 189,934 students and 274 schools across 333 square miles within greater Houston, HISD is the largest public school system in Texas and the eighth largest in the nation. Fourteen percent of the district’s buildings are enrolled in ERS.

HISD has been paid approximately $200,000 since it started participating in demand response in October 2021. It is projected to receive another $44,000 in revenue for the ERS Winter Season that ends in March.

HISD and San Jacinto College are just two examples of large Texas energy users benefiting from helping the grid while ensuring the comfort and safety of their students and faculty. In addition to the ERS program, ERCOT offers a mix of other grid services opportunities for commercial, industrial and institutional customers in Texas, including different ways to reduce energy charges and earn revenue.

If you would like to learn more about how your Texas organization could save money, get paid and help the grid, visit our Texas demand response page.

Contrary to what it may seem, artificial intelligence has not taken over the world, or at least not yet. But you can be excused for believing that AI is in control given the buzz surrounding the technology’s rapidly expanding reach into everything, everywhere – and the world of energy is no exception.

Curious as to how AI views the optimization of distributed energy resources, we asked ChatGPT how AI can be used to optimize DERs. Although ChatGPT summarized available information nicely, the popular, AI-powered natural language processing tool stopped short of telling an energy user how they can optimize their DERs and how they would benefit.

Here are four ways that AI can optimize DERs, according to ChatGPT, along with CPower’s comments on each.

1) Optimizing DERs for Demand Response

ChatGPT says: AI can analyze energy consumption patterns and predict demand fluctuations. By considering factors like weather, time of day and user preferences, AI algorithms can optimize the timing and magnitude of energy generation and storage to match demand. This helps balance supply and demand, reducing peak loads and optimizing the utilization of DERs.

CPower adds: Flexible DERs are ideal for balancing supply and demand and avoiding blackouts or brownouts because they can provide a range of valuable grid services. AI can help customers optimize participation in demand response programs for the good of their organization and the grid. For example, in working across multiple DERs, customer sites and DR programs in real-time, CPower’s EnerWise® Site Optimization helps energy users make money, reduce costs or both by providing grid services that improve reliability.

2) Forecasting Energy

ChatGPT says: AI can leverage historical data, weather patterns and other relevant information to accurately predict future energy generation and consumption. This enables proactive planning and scheduling of DERs, allowing for better integration with the grid and avoiding potential imbalances.

CPower adds: Given that the grid often struggles to maintain balance through challenges, like extreme weather or unexpected changes in supply or demand, AI’s ability to forecast accurately is vital in enabling the fast and flexible grid that we need to power the clean energy transition. Real-time insight into demand is increasingly critical as intermittent renewable generation resources, like solar and wind, account for an ever-larger percentage of the nation’s power mix.

3) Allocating Resources

ChatGPT says: AI can optimize the allocation of energy resources in a distributed network. By considering factors like energy prices, load profiles and system constraints, AI algorithms can determine the most efficient distribution of energy generation, storage and consumption across DERs. This leads to better utilization of available resources and reduces energy waste.

CPower adds: The ability to quickly dispatch DERs in response to shifts in supply or demand is essential to keeping the grid balanced. EnerWise helps maintain balance by automatically allocating each asset at a site to available programs on an hourly basis within the constraints of the hardware or associated permitting/ incentive structures.

4) Participating in Energy Markets and Trading

ChatGPT says: AI can facilitate the participation of DER owners in energy markets. By analyzing market conditions, price signals and regulatory requirements, AI algorithms can guide decision-making for optimal energy trading. This enables DER owners to sell excess energy back to the grid or participate in peer-to-peer energy trading platforms, maximizing their economic benefits.

CPower adds: Combining technology with human know-how remains essential to fully unlocking the value of DERs. For example, while EnerWise efficiently enables DER participation across all available on-bill cost avoidance options and grid services programs, CPower’s experts mitigate revenue complexity and minimize risk for customers by managing changes in more than 60 solutions nationwide, including automated DR solutions.

Looking ahead, ChatGPT noted that optimizing DERs with AI enhances their efficiency, reliability and sustainability while unlocking the full potential of renewable energy sources. At CPower, we would add that we are enabling a flexible, clean and dependable energy future by forming the nation’s largest virtual power plant. In aggregating 6.4 GW of flexible DER capacity across more than 24,000 customer sites, we are helping to create the Customer-Powered Grid™ that will smooth the energy transition while helping energy users earn the most value from their resources.

If you would like to learn more about EnerWise or other ways to optimize your energy assets, call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out how we can help you create and implement a DER strategy that works.

Kyle Harbaugh

Senior VP | Technology

Kyle is a results-driven leader with a track record of delivering high-value products that increase revenue, improve organizational productivity and create large-scale cost savings. A motivated executive who desires to lead fast-paced teams through the creative and challenging process of bringing products to life, from whiteboard to launch.

As Senior Vice President at CPower, he is responsible for Information Technology and Product Management. Previously, he held several technology leadership positions at Constellation Energy. He is also an AEE Certified Energy Manager (CEM) and an AEE Certified Demand Side Management professional (CDSM).

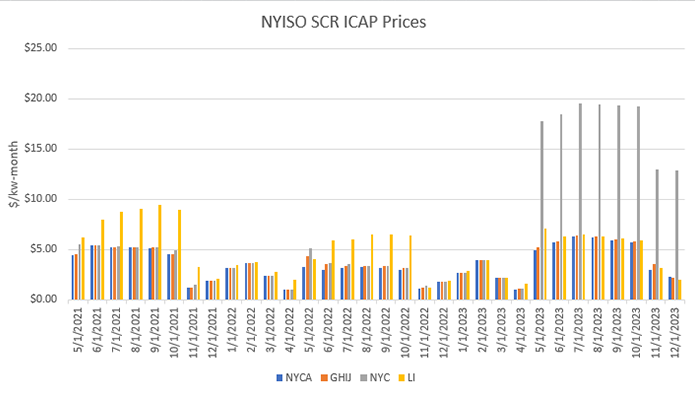

Surging capacity prices present swelling opportunities for commercial, industrial and institutional energy consumers willing to shed load in New York.

With prices up 300% since 2019, participants in the New York Independent System Operator (NYISO)’s Special Case Resources (SCR) Program can earn revenue while reducing costs—without compromising their operations. Customers can also further boost their financial benefits by capitalizing on demand response programs through the state’s utilities, thereby maximizing revenue streams to lower costs.

Seizing the opportunities available begins with enrolling in the SCR Program. Customers who enroll by the end of the month could begin participating as soon as February and earn three months of revenue in the Winter SCR Program, which spans from November to April. The Summer SCR Program will last from May to October.

Program prices typically average $4 per KW in winter and $6 per KW in summer. At Multiple Intervenors Annual Meeting in October, CPower shared how some industrial customers earn $46,000 per MW of curtailable load for two hours of annual curtailment in SCR.

Customers earn passive revenue in SCR for 10 months out of the year just by being ready to help the grid. Except for a one-hour Summer test commitment in August and a one-hour Winter test commitment in February, customers have not been asked to curtail loads for any grid emergencies in recent years.

Additionally, there are several demand response programs available to C&Is in New York through local utilities, such as the Commercial System Relief Program (CSRP) and Distribution Load Relief Program (DLRP). Customers can reap more revenue by using the same curtailment practices to participate in more than one program because SCR, CSRP and DLRP can be combined, or “stacked.”

The value of demand response programs will likely continue to rise as well. The same factors that have driven prices up in recent years should remain contributors, such as the retirement of electricity-generating power plants amidst increasing demand for electricity due to the electrification of heating and transportation.

Prices will rise further if demand outpaces supply, which can cause brownouts or blackouts. For example, NYISO has warned that a possible 446 MW shortfall threatens grid reliability in New York City for Summer 2025.

If an energy consumer would like to support grid reliability while earning revenue, CPower can project how much revenue a customer could earn through demand response programs based on market conditions. Beginning with the SCR program, the longest-running demand response program in New York, CPower can estimate earnings for any combination of SCR, CSRP and DLRP participation.

If you would like more information, please contact me at 860-371-5518 or at keith.black@cpowerenergy.com.

Keith Black

As CPower’s Regional Vice President and General Manager for the Northeast, Keith has leveraged his unique combination of sales and operations expertise, energy business relationship development, channel development, sales opportunity identification and solutions management, backed by his intrinsic talent for building winning business strategies, to help the company and its customers achieve strong and sustainable financial gains.

In leading CPower’s business and growth strategy for New England and New York, he has helped expand New England’s leading edge of solar, storage, and residential monetization and captured market share in all aspects of the evolving DER landscape in New York. Succeeding in these exciting and cutting-edge DER opportunities has come with a complex array of technologies, controls and partner integrations, as well as a demanding and high touch for his team.

A versatile, high-energy executive, he has extensive experience in leading high-performing teams, at businesses from Fortune 500 organizations through start-ups, and guiding companies to profitable growth. With more than 30 years of experience in the energy industry, he has become a trusted energy advisor to both prospects and customers, enabling them to reduce risk, lower costs and use renewable resources when possible.

The steadily declining costs of solar, wind, batteries, EVs and other key technologies—borne by market forces and big policy initiatives like the Inflation Reduction Act—seem all but certain to transform America’s energy system from one primarily reliant on oil and gas to one that is increasingly electrified and renewable—a process often referred to as the energy transition.

To make this energy transition a smooth one, policymakers are increasingly clamoring for grid flexibility: resources that can quickly respond to rapidly changing conditions to keep the grid in balance. Grid flexibility will continue to come in several forms; but distributed, demand-side solutions—dubbed DERs (distributed energy resources) and VPPs (virtual power plants)—are gathering more and more interest, from town halls and statehouses all the way up to the White House.

And believe it or not, if you are a demand response participant, you are a valuable component of the nation’s fleet of DERs and VPPs.

In a new whitepaper, Mathew Sachs, CPower’s Senior Vice President of Strategic Planning and Business Development, and I break down what is driving this growing need for grid flexibility; what all these new terms mean (in plain English) and how they relate to more-familiar concepts like demand response, capacity and energy; and why this creates significant long-term opportunity for energy users in what we call the Customer-Powered Grid™.

We aimed to keep this short whitepaper informative, constructive to the latest research and policy work, and with your ‘so what?’ in mind. Ultimately, we wrote it to start a conversation with you.

The energy transition is already in motion, but the smoothness or rockiness of this massive shift—compounded by an aging grid and extreme weather—is an open question. It’s a question that CPower wants to work on with customers, policymakers, grid operators, utilities and other key stakeholders to resolve for our common safety and prosperity.

We hope you’ll give the whitepaper a read, and reach out at vpps@cpowerenergymanagment.com with thoughts, comments and questions.

Read our full whitepaper to learn more: Creating the Customer-Powered Grid™: Enabling the Energy Transition with Distributed Energy Resources and Virtual Power Plant.

Ben Pickard

Ben Pickard manages strategic M&A and new growth initiatives for CPower as its Vice President of Corporate Development. Prior, Ben was a Director at National Grid, where he developed and executed strategic applications of venture-backed technology to some of the utility company’s most challenging problems; as well as non-regulated distributed energy investments and partnerships including with EnerNOC, Enbala and Sunrun, and scaled entry into renewable project development via Geronimo Energy.

Earlier roles include infrastructure principal investing with the Macquarie Group, urban climate policy with the Clinton Foundation and distributed energy business creation spanning lighting retrofits, rooftop solar, energy storage, and backup generation. His market and policy analysis on electric utilities has appeared in Greentech Media and the New York Times. Ben is based in New York City and earned an AB magna cum laude in Social Studies from Harvard.