Seasonal Readiness 2024

The Booming Potential of Virtual Power Plants

A recent Bloomberg opinion piece contrasted the massive growth in distributed energy resources (DERs), such as rooftop solar and electric vehicles, with sluggish deployment of other clean energy solutions, such as wind power and transmission upgrades, as the world races to reach net zero emissions. While the author was spot on in many respects, the piece failed to account for the role that Virtual Power Plants (VPPs) can play in augmenting the ability of DERs to support the entire grid, and how utility mindsets are shifting.

VPPs aggregate and coordinate distributed energy assets like flexible load assets, rooftop solar, stationary batteries and electric vehicle chargers. This turns these DERs into a reliable block of flexible capacity that can support a variety of grid needs. With VPPs we can harness the rapid expansion of DERs for the benefit of all and continue driving greater decarbonization and energy reliability while we work through longer timelines for other necessary pieces of the new energy economy.

Furthermore, VPPs provide grid benefits at a far lower cost than alternatives. A study released earlier this year found that the net cost to a utility of providing resource adequacy from a VPP is roughly 40% to 60% of the cost of alternatives, which translates into a 60 GW VPP deployment meeting future resource adequacy needs while saving $15 billion to $35 billion.

There is growing public and private support for VPPs. Recently, the day before the opinion piece was published, the U.S. Department of Energy released its Pathways for Commercial Liftoff report for VPPs. The report found that tripling the current scale of VPPs to 80-160 GW by 2030 could expand the U.S. grid’s capacity to reliably support rapid electrification while reducing overall grid costs by $10 billion per year. Not only that, but there are up to $100 Billion in loans available to support VPP deployment.

Utilities can’t afford to ignore these cost savings, and are highly motivated to gain better visibility and control of DERs to maintain the stability of the grid. Therefore, we have many reasons to be optimistic about the rapid growth in VPPs over the next decade. Any forward-looking energy system analysis that doesn’t include VPPs is incomplete.

VPPs can increase the impact of DERs and buy precious time for technologies like wind generation and transmission upgrades to progress. VPPs won’t solve the climate crisis alone, but they are a promising tool to accelerate the clean energy transition. With their flexible capacity, they can bridge the gap created by the sluggish deployment of technologies such as wind power by leveraging existing resources until large-scale renewables can fully deliver.

Michael Smith

Michael Smith is a visionary and innovative leader who brings more than 25 years leadership experience in the energy industry to CPower as its CEO. Michael joined CPower from ForeFront Power, where he was the CEO of the company’s North American solar and energy storage business, responsible for strategy and all business areas across the U.S. and Mexico.

Prior, Michael served as Senior Vice President, Distributed Energy, at Constellation, the retail energy subsidiary of Exelon Corp., where he was responsible for Constellation’s distributed solar, energy efficiency, and energy asset operations businesses across the U.S. He also served as Vice President, Innovation and Strategy Development, for Exelon Generation, and led Constellation Technology Ventures, Exelon’s venture investing organization. Earlier, Michael was Vice President and Assistant General Counsel for Enron Energy Services and a trial lawyer at Bricker & Eckler, LLP.

Possible 446 MW Shortfall Threatens Grid Reliability in NYC for Summer 2025

Photo Credit: New York Independent System Operator

A summer like this year’s could be trouble for New York City in 2025.

Earth’s hottest summer on record lingered into early September in the Big Apple, as the city posted its first official heatwave of the year with three consecutive days of high temperatures exceeding 90 degrees Fahrenheit.

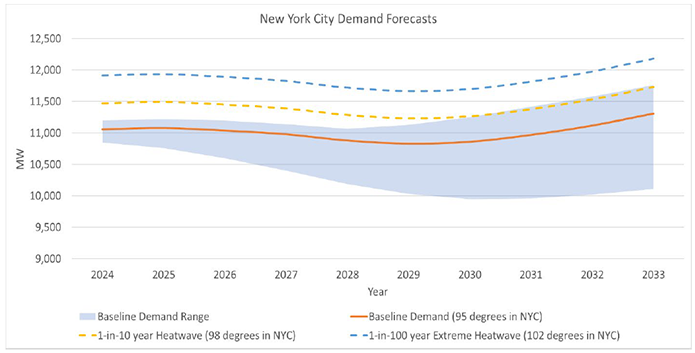

Should the summer two years hence also be especially hot, New York City could grapple with blackouts or brownouts. The New York Independent System Operator (NYISO) has projected a deficit of as much as 446 MW on the peak day during expected weather conditions (95 degrees Fahrenheit).

The baseline summer coincident peak demand forecast for New York City (Zone J) in 2025 increased by 294 MW in the past year, primarily due to the increasing electrification of transportation and buildings, NYISO noted, in identifying a “reliability need” in its Q2 Short-Term Assessment of Reliability (STAR).

Also, NYISO noted, as of May 1, 2023, 1,027 MW of affected peak generation plants have deactivated or limited their operations under the New York State Department of Environmental Conservation’s (DEC’s) “Peaker Rule,” which provides for a phased reduction in emission limits, in 2023 and 2025, during the ozone season (May 1-September 30). An additional 590 MW of peakers are expected to become unavailable for summer 2025, all of which are in New York City, thereby resulting in a total unavailability of 1,617 MW of peaker generation capability.

In terms of possible relief, the DEC regulations include a provision to allow an affected generator to continue to operate for up to two years, with a possible further two-year extension, after the compliance deadline if the generator is designated by the NYISO or by the local transmission owner as needed to resolve a reliability need until a permanent solution is in place. So, at least some of the peaker generation capacity that is currently expected to be unavailable could instead remain available through a two-year extension, and an additional two years thereafter if an additional extension were granted, thus perhaps mitigating the near-term reliability need for New York City.

Also, “The New York City transmission security margin is expected to improve in 2026 if the Champlain Hudson Power Express (CHPE) connection from Hydro Quebec to New York City enters service on schedule in spring 2026, but the margin gradually erodes through time thereafter as expected demand for electricity grows,” according to NYISO’s STAR report.

Looking beyond 2025, NYISO warned that the forecasted reliability margins within New York City may not be sufficient if the opening of the CHPE, which will deliver 1,250 MW of renewable power into the New York metro area, is significantly delayed. Reliability margins also may not be sufficient if additional power plants become unavailable or demand significantly exceeds current forecasts, NYISO noted.

“Without the CHPE project in service or other offsetting changes or solutions, the reliability margins continue to be deficient for the ten-year planning horizon. In addition, while CHPE is expected to contribute to reliability in the summer, the facility is not expected to provide any capacity in the winter,” according to NYISO.

In the meantime, Con Edison, as the Responsible Transmission Owner, is solely responsible for developing a regulated solution to the near-term reliability need that NYISO has identified for summer 2025. NYISO has also solicited market-based solutions.

Per NYISO: “If proposed regulated or market-based solutions are not viable or sufficient to meet the identified reliability need, interim solutions must be in place to keep the grid reliable. One potential outcome could include relying on generators that are subject to the DEC’s Peaker Rule to remain in operation until a permanent solution is in place.”

A reliability need could also drive up capacity prices for New York City in summer 2025, if the possible conditions that NYISO has warned could be created by a combination of escalating demand and the retirement of generators come to fruition.

As this is an emerging and evolving situation, CPower will follow it closely. If you have immediate questions or would like information in the meantime, please contact us online or at 844-276-9371.

Keith Black

As CPower’s Regional Vice President and General Manager for the Northeast, Keith has leveraged his unique combination of sales and operations expertise, energy business relationship development, channel development, sales opportunity identification and solutions management, backed by his intrinsic talent for building winning business strategies, to help the company and its customers achieve strong and sustainable financial gains.

In leading CPower’s business and growth strategy for New England and New York, he has helped in expanding New England’s leading edge of solar, storage, and residential monetization and capturing market share in all aspects of the evolving DER landscape in New York. Succeeding in these exciting and cutting-edge DER opportunities has come with a complex array of technologies, controls and partner integrations, as well as a demanding and high touch for his team.

A versatile, high-energy executive, he has extensive experience in leading high-performing teams, at businesses from Fortune 500 organizations through start-ups, and guiding companies to profitable growth. With more than 30 years of experience in the energy industry, he has become a trusted energy advisor to both prospects and customers, enabling them to reduce risk, lower costs and use renewable resources when possible.

Seasonal Readiness 2023

NY Utility Con Edison Sees DERs and Demand Response Programs that Use Them in its Future (and Present)

Con Edison’s grid of the future aims to deliver 100% clean energy by 2040.

The New York electric utility in charge of delivering safe, reliable energy to 10 million people living in New York City and Westchester County knows full well what’s at stake during their drive to a cleaner, more dependable grid.

Like any utility in the country striving toward a future powered less from fossil resources and more from renewables and other clean sources, Con Edison must deal with the inherent intermittency issues renewable resources such as wind and solar present.

Unlike most utilities in the US, however, Con Edison has more citizens and businesses depending on them.

That’s why a key initiative of their plan to build a “resilient, 22nd-century electric grid” of the future involves significantly expanding distributed energy resources (DERs), which are small, decentralized, electrical systems that are connected to the grid and can consume, produce, or store electricity.

DERs, as regular readers of The Current likely know by now, include curtailed loads from commercial and industrial organizations participating in demand response programs, which pay organizations for using less energy when the grid is stressed due to high electrical usage or when electricity prices are high.

Con Edison has for years counted on demand response programs to help lower peak usage on its grid with popular demand response programs such as the Distribution Load Relief Program (DLRP) and the Commercial System Relief Program (CSRP), both of which were launched in 2016 and continue to be popular among participating organizations today.

In 2020, the New York Public Service Commission established two new demand response programs, Term-Dynamic Load Management (Term DLM) and Auto Dynamic Load Management (Auto DLM), to further help utilities in the Empire State reduce peak loads during times of high electrical use.

Term DLM and Auto DLM specifically aim to help New York reach its clean energy goals, which are among the most ambitious in the US, by allowing capacity from behind-the-meter DERs such as energy storage, on-site generators, CHP units, and more to participate in demand response.

Con Edison hopes the revenue earned by Term DLM participants inspires New York organizations in the utility’s territory to invest in DER technology. Marlon Argueta, Con Edison’s manager of demand response programs announced as much in a recent interview when he said he hopes “the revenue certainty the Term-and Auto-DLM programs provide will encourage participants to invest in battery storage and other clean energy technologies for demand response.”

It’s those clean technologies, Con Edison believes, that will help New York reach its clean energy goals. Those same technologies can help New York City organizations comply with climate-focused regulations such as Local Law 97, which establishes emissions regulations on buildings in the city over 25,000 square feet that must be complied with beginning in 2024.

An estimated 50,000 buildings in New York City stand to be affected by Local Law 97. Many are in the commercial sector and may require comprehensive retrofits, which can be partially or perhaps fully paid for with revenues earned from participating in Con Edison’s demand response programs.

Flexible consumer demand, which DERs certainly provide organizations that possess them, is helping to evolve the electrical grid from, in the words of senior advisor to the Regulatory Assistance Project (RAP) Mike Hogan, “a world where we forecasted demand and scheduled supply to a world where we will forecast supply and schedule demand.”

This grid of tomorrow where demand follows supply instead of the other way around as the case has been since the grid was invented is the grid of the future–not just for Con Edison, but for utilities and grid operators across the country.

Learn more about how CPower’s Building Management System-as-a-Service can turn your New York building into a smart building, lower your energy costs, and earn revenue for helping the grid.

Seasonal Readiness 2022

State of the New York Energy Market in 2021

NYISO President and CEO Richard Dewey believes that market design is the path forward for New York as the state looks to keep its grid reliable as the state pursues its climate goals. In this webinar CPower’s New York team analyzes just what those market designs entail and how local, state, and federal regulations might impact New York’s energy market.

SOTM 2021 Webinar Series

Seasonal Readiness 2021

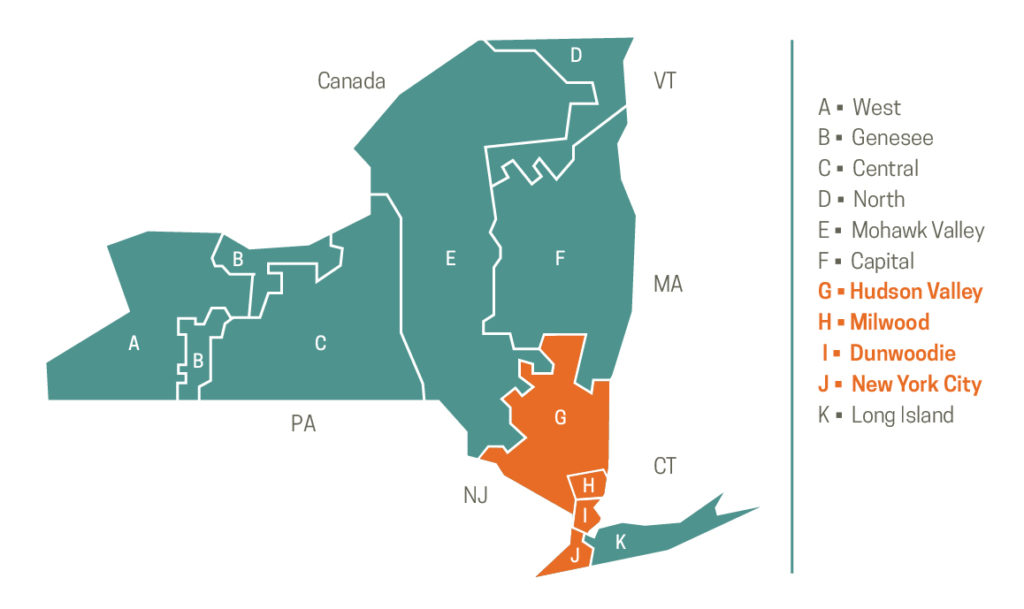

FERC Order Removes Restrictions for Utility Demand Response Resources in New York Zones G-J

Good news on the regulatory front for new demand response resources from New York’s zones G-J entering NYISO’s Installed Capacity Market.

On February 18, 2021, the Federal Energy Regulatory Commission (FERC) issued an Order that overturned a portion of its previously issued Oct. 7, 2020 Order in the paper hearing on whether utility demand response programs Commercial System Relief Program (CSRP) and Distribution Load Relief Program (DLRP) are intended to provide benefits solely to the distribution system (i.e. not for providing similar services to wholesale capacity) and whether the revenues from such programs should be included in new Special Case Resources (SCR) entering the market in New York’s ‘Mitigated Capacity Zones’ G-J Offer Floor calculations as part of Buyer-Side Mitigation (BSM).

FERC’s Feb. 18 Order excludes CSRP revenues (in addition to DLRP revenues as the Oct. 7 Order did), making it much more feasible for most new SCRs to pass the Offer Floor test and not have to sell into New York’s installed capacity (ICAP) market at a price point that is unlikely to clear.

Customers located in Mitigated Capacity Zones who are new to the NYISO SCR program are now significantly less likely to 1) be subject to Buyer-Side Mitigation (BSM) and 2) be required to offer to sell capacity at or above an offer floor price that may not clear in the market.

Rather than run the risk of being found subject to buyer-side mitigation and have an offer floor applied (that carries with the Resource until it clears in at least 12, not necessarily consecutive, monthly Spot Auctions), DR participants will no longer need to choose between retail and wholesale markets to provide DR.

Resources capable of providing different types of DR services will be able to realize the full value, benefiting both the bulk power and distribution system operations.

The order helps to unlock the full value stack of wholesale and retail demand response values to participating customers. Subsequently, new demand response customers no longer need to choose between retail and wholesale markets in which to provide demand response resources.

What is Buyer-Side Mitigation?

Buyer-Side Mitigation (BSM) helps maintain the New York energy market’s integrity by preventing power providers from exerting market power by offering into the capacity market at an artificially low price.

BSM helps ensure both energy providers and generators are not able to exercise unfair buyer-side market power—a form of monopoly control over a market.

For example, energy providers that receive “out-of-market” payments such as state subsidies could have an unfair advantage over other power providers who do not receive out-of-market payments when it comes to offering in New York’s capacity market since the subsidized resources could offer into the market at a price that is lower than that of unsubsidized resources.

Allowing subsidized resources to offer into the capacity market at an artificially low price would distort the actual cost and the resulting market price of capacity when power providers compete fairly in the free market.

What is the Offer Floor Test?

Without getting overly complicated with details, the Offer Floor test is used to determine if a given resource is either subject to or exempt from Buyer-Side Mitigation.

NYISO defines the Offer Floor Test’s calculation for new SCRs as follows:

The Offer Floor for a Special Case Resource shall be equal to the minimum monthly payment for providing Installed Capacity payable by its Responsible Interface Party, plus the monthly value of any payments or other benefits the Special Case Resource receives from a third party for providing Installed Capacity, or that is received by the Responsible Interface Party (RIP) for the provision of Installed Capacity by the Special Case Resource, except that it shall exclude the monthly value of any payments or other benefits the Special Case Resource receives from a retail-level demand response program designed to address distribution-level reliability needs that the Commission has, on a program-specific basis, determined should be excluded.

A Brief History of Buyer-Side Mitigation and Special Case Resource in New York

The preceding article’s timeline begins in February 2021 with FERC overturning its October 2020 order. Let’s review how the issue has evolved over the previous thirteen years.

Much of the following has been paraphrased from Section II of Docket No. EL16-92-001-NY Public Service Commission v. NY Independent System Operator

Special Case Resources have been subject to NYISO’s Buyer-Side Mitigation since September 2008. In May 2010, FERC approved an Order that excluded certain payments that an SCR may receive from state-regulated, distribution-level demand response programs.

In March 2015, FERC clarified that it did NOT intend to grant an “exemption for all state programs that subsidize demand response” and further explained that a state “may seek an exemption from the Commission [FERC] pursuant to section 206 of the Federal Power Act if it believes that the inclusion in the SCR Offer Floor of rebates and other benefits under a state program interferes with a legitimate state objective.”

On June 24, 2016, the NYSPSC, the New York Power Authority, the Long Island Power Authority, NYSERDA, the City of New York, AEMA, and NRDC filed the Complaint against NYISO, challenging NYISO’s imposition of BSM on SCRs on the grounds that they interfere with legitimate state objectives. The parties requested a blanket exemption from BSM for all SCRs receiving payments pursuant to a “utility-administered distribution-level Demand Response program.”

The parties requested that the Commission approve an exemption for each of the individual utility-administered, distribution-level programs discussed in the Complaint.

On February 3, 2017, FERC ordered a blanket exemption for all new SCRs, explaining that SCRs had no incentive or ability to affect wholesale market rates. FERC also stated that existing SCRs currently subject to mitigation would not be eligible for the exemption, due to the FERC’s “long-standing practice” of not adjusting mitigation measures after a resource enters the market.

On March 6, 2017, Independent Power Producers of New York, Inc. (IPPNY) filed a request for rehearing, arguing that the SCRs, considered in aggregate, could affect wholesale market rates.

In February 2020, FERC issued an Order revoking the blanket exemption granted in the February 2017 Order.17 FERC also ordered the initiation of a “paper hearing” to determine if any specific New York programs to support SCRs should be exempted.

Peter Dotson-Westphalen coordinated AEMA support on the issue of Buyer-Side Mitigation and Special Case Resources following FERC’s February 2020 ruling and coordinated multiple comment filings with staff from NYPSC, NYSERDA, City of New York, NRDC, and Energy Spectrum. He contributed heavily to the drafting work to the joint comments, as well as the testimony of Katherine Hamilton (on behalf of AEMA) in the paper hearing.