2020 State of Demand-Side Energy Management in North America

ISO-NE: Fuel Security Remains New England’s Biggest Concern

In its 2019 State of the Grid Report, ISO-NE revealed that the grid’s most pressing vulnerability is energy security. The ISO cited its “inadequate fuel delivery infrastructure” as the reason electricity demand during extended winters may go unmet.

As we highlighted in last year’s version of this book, New England’s winter fuel security is an energy supply problem not a capacity shortfall problem. ISO-NE has stated that as wind and solar sources increasingly contribute to the grid’s fuel mix along with more just-in-time fuel, the supply problem that has created a winter fuel shortage could become a year-round issue for New England.

ISO-NE believes market design is the answer.

ISO-NE market redesign proposal: incentivize generators

ISO-NE’s goal with redesigning its market is to compensate resources that help the system maintain its energy inventory.

Consider natural gas generators. Currently, the economics in New England are such that natural gas generators do not keep inventory for multiple days. Rather, they offer their capacity into the day-ahead market. Why? Economics. The generators feel it’s in their best financial interest to take positions in the capacity market and reap the reward from emergency conditions as opposed to what they would earn in the energy market.

Normally, that wouldn’t be a problem. That’s how the market is currently designed, after all. But remember, New England’s winter fuel problem is supply-related. The region has plenty of capacity. It needs more supply, particularly during extremely cold conditions.

OK, says ISO-NE, let’s introduce a proposal to redesign the market on the energy side and incentivize natural gas generators to keep more inventory that can be delivered in the winter, thereby alleviating the fuel security risk.

Problem solved. Right? Well…theoretically yes. But by altering the market on the energy side to incentivize generation, ISO-NE may unwittingly affect its capacity market in a negative way.

Unintended consequences for the New England capacity market

Natural gas generators typically take large positions in the capacity market, offering at a specific price that, when accepted, tends to establish capacity’s clearing price in New England’s forward capacity market.

If natural gas is incentivized in the energy market, as ISO-NE’s market redesign proposal intends, natural gas generators may become price takers in the capacity market. They no longer would have an interest in taking a large capacity position in the market. As a result, the price of capacity could fall from year to year.

As more renewables come online and ISO-NE looks to integrate more distributed energy resources onto its grid, a depressed capacity market poses problems. ISO-NE has proposals in the works to address these concerns.

ISO-NE’s Market Proposals

In April 2019, ISO-NE introduced three ideas to build on New England’s competitive wholesale electricity structure. The goal is three-pronged:

- Strengthen generation owners’ financial incentives to undertake more robust supply arrangements.

- Reward resource’s flexibility to mitigate energy supply uncertainties that take place throughout the day.

- Efficiently allocate electricity production across multiple days from resources that have limited (non-just-in-time) energy sources.

To accomplish these goals, ISO-NE introduced three new components that are currently under review. For commercial and industrial organizations looking to optimize their demand-side energy resources, these proposals are worth keeping an eye on because they by and large affect the region’s capacity market in what ISO-NE hopes is a positive way.

The Multi-day ahead market

This would be a voluntary market for forward energy transactions extending the current (single) day-ahead market several days in advance of the operating day, with daily offers rewarded with the price at which they clear on that day.

By extending the day-ahead market to several days, ISO-NE seeks to enable suppliers to refine their energy positions (adjusting due to changes in fuel supplies, costs, and delivery capabilities) prior to the delivery day. The ISO figures it can optimize the region’s limited energy supplies and avoid scarcity pricing conditions during extreme cold weather when the region might otherwise be forced to turn to costly, out-of-market resources.

While the multi-day ahead market is supply-side in nature, it may have a demand-side impact if it succeeds in thwarting the exceptionally high energy prices that trigger a demand response event. Without high prices, a demand response event is less likely to occur.

But that’s not necessarily bad news for DR participants. Although they are less likely to be dispatched to curtail their loads, DR participants will still be required to comply with a seasonal test for which they are paid.

New Ancillary Services in the Day-Ahead Markets

Most energy resources in New England operate during hours of the day for which they receive an energy supply award in the day ahead market. But what happens when one of those cleared day-ahead resources is unable to operate?

ISO-NE calls these instances “energy gaps” in the operating plan. The resources that were incentivized to run but can’t must be replaced by resources that were not incentivized to run.

The way the region’s energy market is currently structured, it simply isn’t profitable to procure fuel in the case of an energy gap. With new ancillary services in the day-ahead market, ISO-NE hopes to remedy the situation by rewarding flexible resources that can fill the gaps when emergency conditions arise.

Exactly how these new services will be rewarded is a detail the ISO is ironing out. ISO-NE has suggested, however, that these new ancillary obligations should be settled like a call option on real-time energy.

Seasonal Forward Market

The third component ISO-NE has proposed is a voluntary forward auction with the goal of facilitating investment in the supplementary energy supply arrangement several months in advance of each season. The aim here is to ensure there is adequate energy supply in the winter.

ISO-NE has some work to do on this front and admits as much. They are exploring a revamp of the existing Forward Reserve Market so that it essentially becomes a forward market for the new ancillary services we previously discussed and may be transacted in the day-ahead market.

This post was excerpted from the 2020 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

2020: The Year Storage Goes Big in New England

All together now…what are the reliability problems an evolving grid with a fuel mix increasingly featuring intermittent, renewable sources like wind and solar facing? Veterans and savvy followers of the New England energy market know the answer to this one knee-jerk. No need to join the chorus. The answer is as easy as picking the Patriots to make the playoffs.

Resource intermittency is a threat to grid reliability.

Solar PV panels can’t generate electricity when the sun isn’t shining. Wind turbines don’t turn without wind blowing. Simply put, solar and wind sources can suddenly find themselves in adverse conditions during which they can’t produce.

So what’s a grid to do?

In New England, as in other progressive deregulated markets in the US like California and New York, the answer is energy storage.

FERC ORDER 841: Let storage in

On February 18, 2018, the Federal Energy Regulatory Commission (FERC) issued Order 841, which directed regional grid operators to remove barriers to the participation of electric storage in wholesale markets.

Order 841 seeks to direct regional grid operators to establish rules that open capacity, energy, and ancillary services markets to energy storage. The Order affirms that storage resources must be compensated for all of the services provided and aims to level the playing field for storage with other energy resources.

In working to comply with FERC 841, ISO-NE now faces a host of challenges familiar to other markets seeking to properly value distributed energy resources in the marketplace. New England may not have the answer, but they have an answer. 2020 looks to be the year demand-side energy storage makes a significant impact in New England, albeit on the distribution side through utilities.

New England realizes the value energy storage can provide in offsetting wind and solar resources’ intermittency. While ISO-NE is working on market redesigns to allow energy storage resources to participate, electric utilities are jumping into the ring in 2020 with a new program that features energy storage in a starring role.

Beginning in 2020, electric utilities will offer a new demand response program that allows for storage to play a critical role in helping the grid maintain balance when demand for electricity threatens to exceed supply.

Introducing Daily Dispatch Demand Response

To help further reduce peaks on their distribution systems, New England utilities National Grid, Eversource, and Unitil have introduced a new demand response program called Daily Dispatch.

Daily Dispatch is designed to allow energy storage (batteries, thermal storage) to participate because of its ability to be dispatched frequently and quickly in response to rising peaks.

The Daily Dispatch program runs during the summer from June through September. The program is intended to be dispatched (as the name suggests) daily with anywhere from 30-60 events each year during the hot months of July and August. Each event is expected to last about two to three hours.

The new program has an attractive incentive of $200 per kW per summer. Customers’ compensation will be based on their average curtailment amount for all the events that are called during the summer.

For example, a customer that curtails an average of 500 kW for each of the Daily Dispatch events would gross $100,000 for their efforts.

The Daily Dispatch program appears to be an instance where we find electric utilities taking a leadership role in optimizing energy storage to reduce peak load by allowing commercial and industrial organizations to monetize the distributed generation assets in which they have invested.

Since it is at the utility level and not an ISO program, Daily Dispatch needn’t rely on the wholesale capacity market to settle payments. Instead, the program can offer a flat per kW rate, thereby allowing participating organizations to monetize their behind-the-meter storage in 2020 as opposed to waiting until ISO-NE establishes its DER valuation policies.

This post was excerpted from the 2020 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

Case Study: UMass Amherst – A Revolutionary Approach to Sustainability Yields Revolutionary Results

State-of-the-art battery storage, an innovative solar PV system, and “stacked” demand management programs provide energy savings, steady revenue, reduced greenhouse gases, and grid reliability for

this revolutionary institution.

Seasonal Readiness 2020

Webinar: State of the New England Energy Market (SOTM Series)

SOTM 2019 Webinar Series

Demand Response in New England: The more things change…

ISO-NE’s implementation of its price-responsive demand construct has led to several changes in its demand response programs.

Three key changes for 2019:

- DR programs are now dispatched based on economic (instead of emergency) conditions.

- DR is now considered fast-acting DR and must be dispatched within 30 minutes of the grid’s call for curtailment.

- DR resources can be offered into both day-ahead and real-time energy markets.

It may seem like the market has changed drastically and therefore demand response participation in New England will also be strikingly different than it was in the past.

While the former may be the case, the latter really isn’t.

The fundamentals of demand response participation in New England have not changed that much from the customer’s perspective. Here’s why:

- DR programs are still dispatched with a 30-minute notification window.

- Because the economic conditions that trigger DR under PRD tend to coincide with emergency conditions, there isn’t expected to be an increase in the number of events called in 2019 under the new construct compared with previous years.

- Audits (tests) proving performance are the same as they were in 2018.

Capacity prices in New England have been trending downward in recent years.

While lower capacity prices mean lower payments for DR curtailments, they are also a sign that New England has procured adequate capacity resources. This means it is probable that there will be fewer events called in the coming years and that those events are not likely to last as long as events in previous years when capacity prices in New England were higher.

Demand Response Programs in New England

ISO-NE offers the following demand response programs:

Active Demand Capacity Resource (ADCR) is a demand response program in which participating loads are dispatched when wholesale electricity prices in New England are exceptionally high.

Launched in June 2018 as part of ISO-NE’s price-responsive demand construct, ADCR replaced the Real-Time Demand Response Program (RTDR).

Passive [On-Peak] Demand Response rewards participating organizations for making permanent load reductions.

Unlike active resources, On-Peak resources are passive, non-dispatchable, and only participate in ISO-NE’s Forward Capacity Market. Eligible behind-the-meter resources include solar, fuel cells, co-generation systems, combined heat and power systems (CHP), and more.

Passive Demand Response participants offer their reduced electricity consumption into the market during both the summer and winter peak hours.

Utility Demand Response Programs

Connected Solutions–National Grid, Eversource, and Unitil are working to lower the amount of total energy our community uses during the summer months when demand for electricity on the grid is at its highest (peak demand).

To help keep their grids healthy and reliable, these utilities now offer the Connected Solutions demand response program that pays businesses to use less energy during peak demand periods.

The rules may be changing in the New England energy market, but for the commercial and industrial organization gearing up for the summer season…demand response is the same sport as it has always been.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

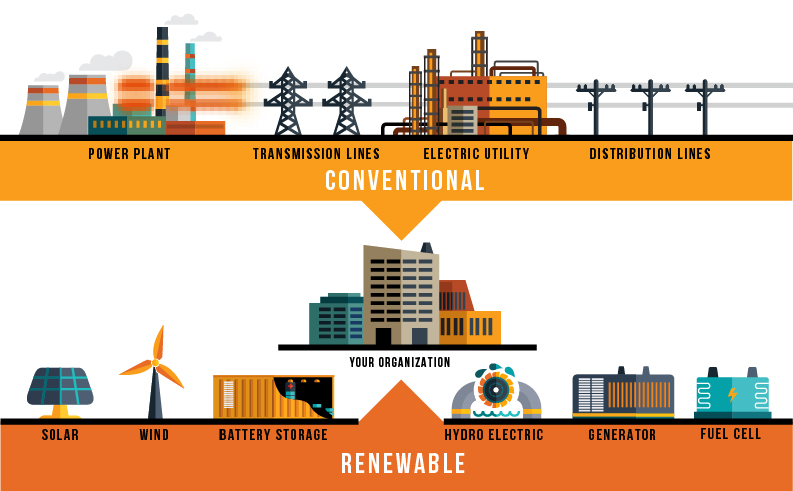

New England’s Emerging Hybrid Grid

Currently, there are two developmental shifts taking place in New England concerning the electricity grid.

- The grid is shifting from conventional generation to renewable energy.

- The grid is also shifting from centrally dispatched generation to distributed energy resources.

What was formerly a traditional power system is becoming a hybrid system with electricity needs met by both conventional resources (natural gas-fired generators dependent on just-in-time deliveries of fuel) and large-scale renewable resources (weather-dependent wind and solar) connected to the regional transmission system.

New England’s hybrid system will also include thousands of small resources connected directly to retail customers or local distribution companies.

As this new hybrid grid emerges, maintaining reliable power system operations will become more complex due to new resources facing familiar constraints on energy production.

The Significance of New England’s Changing Fuel Mix and Evolving Energy Policies

In its State of the Grid 2019 presentation, ISO-NE provided a concise take-a-way statement:

“[The] Grid is holding steady on a strong power foundation, but the power system is changing and vulnerabilities are growing.”

Let’s first examine the grid’s strong fundamentals that have led to reliable power being supplied to the region over the last two decades.

ISO-NE has identified four key ingredients for the grid’s continuous reliability:

- Reliable Operations–Record cold, heat, demand, and major equipment outages have tested the grid in recent years. The grid has held.

- Robust transmission system–Big investments in system upgrades have increased grid efficiency and enhanced competition.

- Resource adequacy–New England’s Forward Capacity Market continues to attract and retain the capacity required to meet demand.

- Established, collaborative decision-making process–The ongoing collaboration between the ISO, market participants, state officials, and consumer advocates over the last 20 years has found and will continue to find solutions to the region’s energy challenges.

Now, let’s examine the grid’s potential vulnerabilities. ISO-NE has identified two areas of concern:

- Energy security risk–As the NE fleet shifts from power plants with stored fuels to resources that depend on weather or just-in-time fuel deliveries, there is growing concern that adequate capacity will be available throughout the region on a year-round basis.

- Shifting policy priorities are challenging competition in the market--NE’s competitive market has delivered reliable energy at fair market prices for the last 20 years. Competition has helped lower wholesale electricity prices while spurning investments of more than $16 billion in cleaner power plants and resources that reduce demand.

That said, the region’s individual state initiatives and mandates aiming toward clean energy goals have created a need for markets to be adapted to sustain the benefits of competition.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

2019 State of Demand-Side Energy Management in North America

The 2019 State of Demand-Side Energy Management in North America is a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.