White Paper: Demand Side Management in US Manufacturing Industrial Sector

DER Monetization for Industrial Facilities

Industrial

White Paper: Leveraging Your Generation Assets To Generate Revenue

Webinar: Leverage Your Generator Assets To Earn Revenue

Properly permitted, your emergency generation—EG—is both a reliability asset and a revenue generator. EG provides a great opportunity to earn revenue and save on energy costs through demand response (DR) and demand management programs.

The path from emergency generation to revenue generation, though, may seem like a complex, confusing, and occasionally contradictory thicket of state and local environmental regulations. Few organizations fully understand the scope and intricacies of EG regulation, which often results in misinformation, missteps, and missed revenue opportunities.

Fortunately, CPower’s extensive experience and knowledge base has led hundreds of organizations through the jumble of regulations and provided a clear path to monetizing EG assets. This webinar covers everything today’s energy managers and engineers need to to know to maximize the benefits of their EG portfolio. It includes:

- A brief history of emergency generation as a component of demand-side energy management, and the numerous rule changes that have created the current EG landscape

- How existing generators can be upgraded to meet increasingly stringent permitting requirements, bringing previously excluded MWs back into the market

- Success stories illustrating how CPower has helped find and reclaim “lost” megawatts and enroll them in lucrative demand response and demand management programs

Join Ray Berkebile, CPower’s nationally recognized EG permitting expert, and CPower engineer Alison Keefe as they lead this in-depth look at how your EG assets can generate revenue for you, too.

Download the slides: Leverage Your Generator Assets To Earn Revenue Webinar (PDF)

Case Study: Desert Water Agency

2.5 MW of monthly demand response commitment gives the Desert Water Agency energy savings and additional revenue to offset costs.

The Customer: Desert Water Agency, Palm Springs, California

The Desert Water Agency (DWA) is a not for profit government agency providing water to the desert resort community of Palm Springs, in the Coachella Valley, as well as adjacent areas. Nearly all of the water that is used in the Coachella Valley comes from a groundwater basin, or aquifer estimated to contain about 30 million acre-feet of water. DWA pumps water using 29 wells spread throughout its retail area and delivers it to 23,000 water connections serving approximately 106,000 residents and businesses.

DWA embraces sustainable energy resources, including hydroelectric and solar, to power its pumps and generate energy savings. A solar field comprising 4,500 ground-mounted fixed tilt panels produces just over a megawatt of energy. The solar facility powers their Operations Center and Water Reclamation Plant and is projected to save the Agency and its ratepayers about $6 million in energy costs during its lifetime.

The Challenge: Tap the Demand Response Revenue Stream

The demand response program offered by CPower pays customers for reducing their energy usage upon same-day notification of a possible grid event. DWA understands the benefit of earning additional revenue by curtailing their power load and using that revenue to further offset energy costs. The key to DWA’s successful participation was technically implementing a curtailment program with the least possible disruption to its operations and its customers. Wells throughout the city that could participate in the program would be turned off when CPower issues a curtailment notification.

That left them with one important question: “Can we survive three to four hours of having wells shut down and still be able to refill our reservoirs to meet customer demand?”

The CPowered Strategy: One Well at a Time

Thankfully, with CPower’s help, the answer was “Yes.”

DWA chose CPower as their demand response provider to manage their participation in the demand response program. CPower provides a team of energy experts to review the Agency’s operations and energy goals. Together, DWA and CPower developed an energy management strategy that gives DWA the tools to optimize their participation in the program.

The strategy called for DWA to start with a small number of wells, to familiarize themselves with the curtailment process with minimal impact on day-to-day operations. As DWA’s staff became more comfortable with the process, more wells were added, until all eligible wells—25 of their total of 29—are now actively participating and generating revenue for the Agency.

“The CPower relationship has been outstanding… I fully trust them. The integrity is always there, they are always reliable and very knowledgeable.”

-Steve Johnson, Assistant General Manager

CPowered Solutions: Power Empowerment

Understanding the Agency’s preference for autonomy over automation, CPower empowered it with the tools to control its energy spend and demand response participation. The Agency can turn individual sites on and off at will upon notification through their supervisory control and data acquisition (SCADA) software to implement the custom-designed energy strategy developed with CPower’s experts. Perhaps best of all, the Agency can manage it all from their central Operations Center, without dispatching staff to well sites under a grid-stressing desert sun.

CPower collects utility meter data for each of DWA’s sites and supplies them with quarterly performance data. These data provide DWA with an understanding of each site’s base load value. The Agency can use these data to decide their optimum load curtailment commitment for each month of the program.

The Results: An Oasis of Cost-Saving Revenue

DWA typically nominates a changing rotation of eight wells each month into the program. The total monthly load drop amounts to about 2.5 MW. This is a significant commitment that helps relieve stress on the electric grid.

The program also provides DWA significant financial incentive for their participation. During a recent six-month period, May-October, they received $105,872.68 in payments for their participation. These incentives allowed them to further offset their energy costs, to the benefit of their customers.

Just as importantly, perhaps, DWA enjoys the total commitment of CPower’s dedicated California energy market experts. The Agency knows from experience that CPower will support their energy goals at every turn, with an energy strategy custom-made to meet their unique requirements.

Download a PDF version of this case study

ERCOT’s Capacity Reserve is Dropping. Here’s What Your Business Should Know.

The Electric Reliability Council of Texas (ERCOT) and independent market analysts agree on at least one thing: there will be about 4,200 MW less fossil fuel capacity in the Lone Star State in 2018, a decrease that can be attributed to the approved retiring of three coal-fired generation plants–Monticello, Sandow, and Big Brown.

Exactly how the decreased capacity reserves will affect the Texas market is less agreeable, at least for now.

ERCOT maintains a capacity reserve margin target of 13.75% of peak electricity demand so the grid operator may serve electric needs in the case of unexpectedly high demand or levels of generation plant outages.

Analysts like Potomac Economics, an independent market monitor for ERCOT, predict the retiring generation plants in Texas will lead to the grid’s capacity reserves dipping below ERCOT’s margin target.

Potomac’s prediction is at odds with ERCOT’s official forecast for capacity reserves in 2018, at least now.

Last May, ERCOT released its bi-yearly Capacity, Demand, and Reserves (CDR) Report, which projected the grid’s reserve margins to be above 18% until 2022 when the margin falls to 16.8%. The report, however, was published several months before the recently announced coal retirements.

After doing the math and subtracting the capacity associated with the retiring units from the 2017 CDR report’s forecast, a breach of ERCOT’s target reserve margin seems possible.

So ERCOT’s capacity reserve may drop below the 13.75% target. What does that mean?

We’ll likely learn the official answer in mid-December 2017 when ERCOT releases an updated CDR report to address what the loss of capacity from retired generation plants will mean to the grid.

Until then, we can make a few educated guesses on how the Texas market will react to decreased capacity based on the market’s recent history.

In the last 10 years, ERCOT’s reserve margin projections have dropped to single digits 10 times, reaching a recent low of 5.8% in 2012. The market has repeatedly bounced back from low projections. It’s worth noting, however, what happens when ERCOT’s capacity reserves actually fall below the grid operator’s target reserve margin.

That last happened in 2011, which was also the last time ERCOT’s scarcity pricing mechanism was triggered.

Scarcity pricing introduces a price floor and price cap to the market when an electricity supply emergency causes concerns of forced power cuts (called emergency load shedding) throughout Texas. When ERCOT’s reserves hit 2,000 MW as they last did in 2011, scarcity pricing sets an automatic cap at $9,000 per MWh.

Now let’s analyze who benefits from scarcity pricing. The short answer is generators. In an energy-only market like Texas, generators make money when the price of electricity spikes. Over the last several years, demand for electricity in Texas has set numerous peak load records, including new monthly highs in July and August 2017.

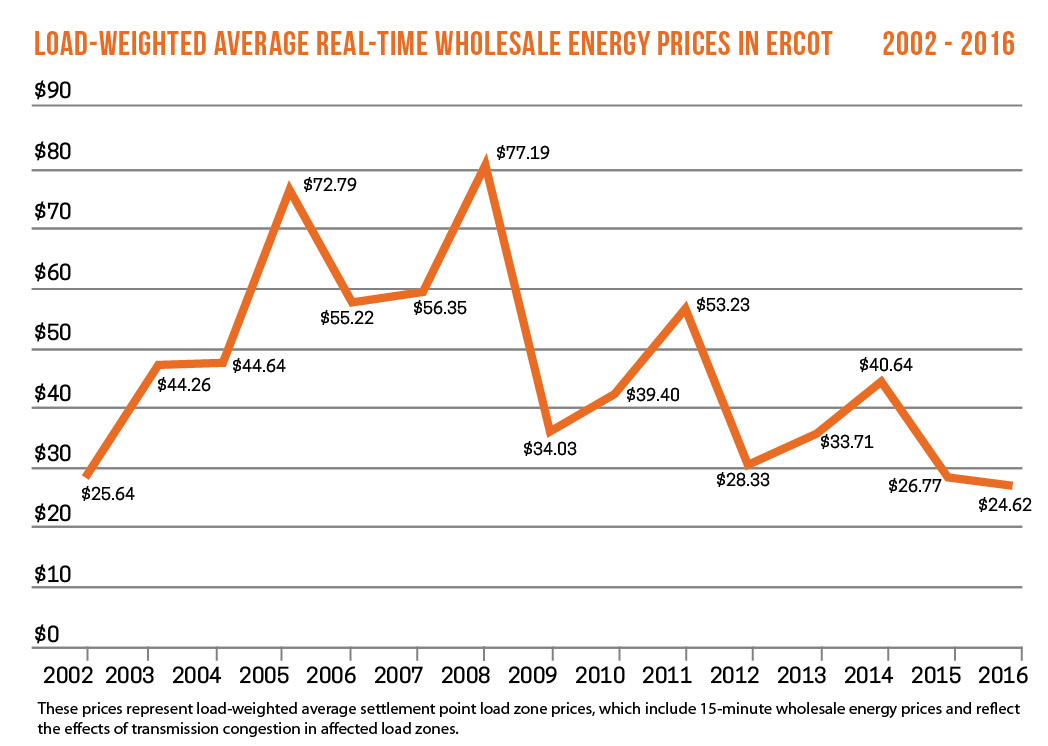

Power prices in Texas, however, have remained relatively stable. In fact, ERCOT reported that 2016 saw average wholesale prices in its real-time market hit an all-time low (see chart below). Increased wind production, which accounted for less than 1% of ERCOT’s power in 2003 rose to 15% in 2016, continues to put downward pressure on prices, as does cheap natural gas supply.

The drop in capacity reserve in 2018 may lead to the kind of price spikes that generators have been waiting for, but generators will not be the only beneficiaries if wholesale prices see a significant rise.

If triggered, scarcity prices will be translated into ERCOT’s day-ahead ancillary services capacity procurements. That could mean financial opportunity for businesses who participate in ERCOT’s Load Resource demand response program, which pays businesses to be on call to curtail their energy use on short notice when the grid is stressed or electricity prices are exceptionally high.

Load Resource, ERCOT’s go-to ancillary service demand response program, already has the potential to pay businesses 2-3 times more than reliability-based demand response programs in Texas like the Emergency Response Service (ERS) program.

If scarcity pricing triggers in 2018, that potential payoff may be a lot bigger in Texas.

Part 1, “ERCOT Fundamentals: DR 101,” introduces you to DR in ERCOT and covers topics ranging from market structure to participating with automation and emergency generators.

Part 2, “Strategies for Maximized Results,” takes your DR knowledge to the next level and shares some important out-of-the-box methods for maximizing your value.

Both webinars are FREE and now open for registration.

How to Maximize Demand Response Earnings with California’s DRAM Program

For most of the last two decades, demand response in California has been largely procured and operated by the state’s electric utilities.

That trend is changing.

Demand response in California is currently experiencing significant changes as regulators implement measures to expand the state’s pool of energy resources and assimilate these resources with the California Independent System Operator’s (CAISO) markets.

This regulatory reform has created new opportunities in California for demand response programs, which pay businesses for using less energy when the grid is stressed or electricity prices are high.

The Demand Response Auction Mechanism

The Demand Response Auction Mechanism (DRAM) was developed in 2014 under the guidance of the California Public Utility Commission (CPUC) in an effort to harmonize utility-based reliability demand response with CAISO, the state’s grid operator.

In December 2014, the Commission issued D. 14-12-024 which requires the state’s IOUs: Southern California Edison Company (SCE), San Diego Gas & Electric Company (SDG&E) and Pacific Gas and Electric Company (PG&E) to design and implement Demand Response Auction Mechanism (DRAM) pilot programs in 2015 for 2016 capacity (DRAM I or 2015 DRAM) and in 2016 for 2017 capacity (DRAM II or 2017 DRAM). The three utilities recently completed a solicitation for 2018/2019 capacity (DRAM III) procuring over 200 MW of DR resources across the state.

Now in its third year, the program seeks to allow CAISO to add reliable demand response resources to areas of California where electric reliability may be at risk.

DRAM is a pay-as-bid program with three goals:

1)Fully integrate DR resources with the CAISO energy market

2) Test whether third parties can bring these resources to the table without structured utility programs

3) Allow residential resources to participate directly in the CAISO markets

The DRAM program also provides market participation testing from a broader base of distributed energy resources, including behind-the-meter storage. Under DRAM, these resources have the opportunity to behave not just as system capacity, but also as local and flexible resources.

California’s recent actions aim to revise the market’s existing demand response program structure and are an indication that DR has an important role to play in the state’s future.

The best way for an organization to take advantage of the DRAM program and the opportunities available in the California Market is to consult a trusted demand-side energy management company.

Such a company can evaluate an organization’s facilities and determine its curtailment capabilities. Next, they can explain in full the many demand response and demand management programs that are available in the California Market and help determine which offer the particular organization the best chance for curtailment success.

To learn more about how CPower can help your organization earn with the Demand Response Auction Mechanism program, please visit CPowerEnergy.com/dram-california.

To continue learning about how the California grid is changing to meet the needs of the future, read: The Evolution of The California Energy Market: How Demand Response and Demand Management will Play Integral Roles in The Golden State’s Energy Future

Understanding kW vs kWh (and Meter Data) to Lower Your Utility Bills

Many customers as well as my colleagues at CPower often ask me about the benefits of installing reliable metering equipment to access energy data in near real time. I typically respond with a handful of advantages (some listed below), but even before going there I find it useful to explain the full context about why these are important.

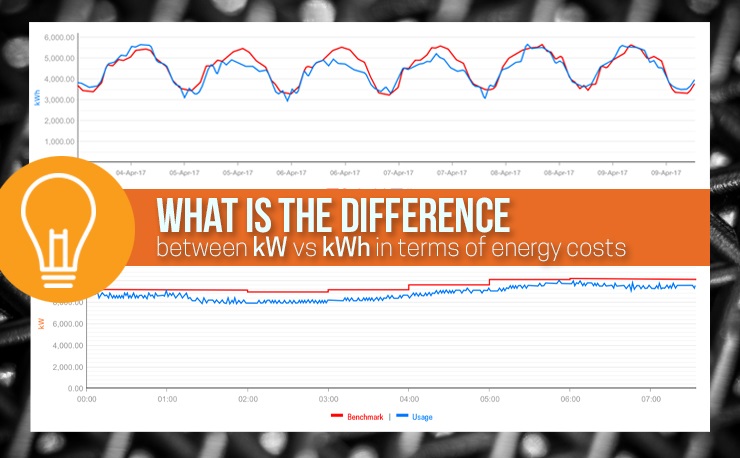

No discussion on the topic would be complete without a basic understanding of Demand (measured in kilowatts or kW) versus Consumption (measured in kilowatt hours or kWh). This is key to making the right choices when it comes to reducing energy costs, since electricity use for a commercial/industrial customer is typically billed and metered after taking at least these factors into consideration:

- Maximum kilowatt use (or kW demand) during a given period, typically in 15- or 30-minute intervals, and

- Total cumulative consumption (in kWh).

So, what’s the big deal between kW vs kWh?

An analogy using traditional light bulbs can help: Consider a single 100W bulb lit for ten hours versus ten 100W bulbs lit simultaneously for one hour. In both scenarios, the total cumulative “consumption” is 1,000 watt-hours (or 1 kWh). In the first case, however, the single light bulb will “demand” 100W or 0.1 kW from the electric supplier. Thus, the utility must have that 0.1 kW ready whenever that bulb is switched on. But note how the second scenario impacts the utility from a “demand” perspective. The electric supplier in this case must be ready to deliver 10x as much ‘capacity’ in response to the demand of the 10 light bulbs burning simultaneously!

Quite simply, here’s the difference. If these two scenarios reflected the behavior of two different customers, and if they were each billed for only their consumption, then both would get the same bill (for 1 kWh of energy used) even though the burden placed on the utility to meet each customer’s energy requirement is very different. Among other reasons, this is primarily why C&I (as opposed to residential) customers are typically metered and billed based on both their hourly “consumption” patterns and their peak “demand” for energy.

Demand-side energy management in near real time

CPower’s savvy demand response (DR) customers effectively leverage the energy they consume as a facility asset. Our diverse customer base covers mid- to large-sized electricity users in commercial, industrial, government and institutional organizations, including water/wastewater pumping and treatment facilities, colleges and universities, public agencies, office campuses, cold storage, data centers and a wide range of manufacturing facilities, to name just a few.

Many of our most active DR participants nationwide additionally leverage real-time metering for its clear advantages, including more visibility and control over load reductions as well as better overall energy management and sustainability benefits. The image above shows just two of the many views available to users via the CPower App (the graph on top shows 7-day hourly interval consumption while the one below shows demand on an intra-day 1-minute interval chart).

Key reasons to get real-time metering installed at your facility:

- You can identify unusual or erratic equipment behavior to help avoid catastrophic failure. This is from a recent real-world example: Our team at CPower was working with the operations team for a large commercial real estate and property management firm, and picked up on unusual/erratic daytime usage patterns at one of their facilities. A look at the major systems of the building revealed that a chiller which had been recently serviced was to blame. Further investigation revealed that during a recent service call the chiller had been severely over-charged with refrigerant. Having a near real-time window into their energy usage enabled the facilities personnel to identify the unusual usage pattern, and proactively remedy a potential chiller issue that could have resulted in thousands of dollars in repair costs and possibly escalated their demand charges had it gone unnoticed.

- Similarly, you may discover unusual, wasteful patterns or aberrations in overall facility energy usage as well as specific areas (e.g., an BAS reset inadvertently switches on all lights in an unoccupied underground parking garage at 2 AM).

- Simplify on-site event planning (e.g., for K-12 schools or colleges) and/or production line scheduling (for manufacturing) with day-ahead pricing and forecasting at your fingertips.

- Quickly and accurately substantiate the impact of your energy efficiency initiatives and sustainability programs (and share results with your team and management).

- Avoid setting a new annual or monthly consumption peak, enabling you to manage demand charges for next year. Click to see more on Peak Demand Management in New England and Texas, for example.

- Immediately evaluate the efficacy of (and fine tune as needed) new load curtailment strategies.

- Further leverage your building automation systems and curtailment planning while minimizing impact on occupants (students, staff, employees, tenants, etc.).

- Facilitate optimized participation in multiple DR programs, including Emergency Capacity, Economic DR, Ancillary Services, and more.

- In addition to monitoring real-time utility load, several customers (i.e. a manufacturer of water valves and a supplier of military components) also view sub-meter data in the CPower App to provide them with a more granular, process-level picture of the energy usage in their facility.

The Bottom line

Real-time metering ultimately increases your DR earnings and savings to fund additional efficiency initiatives, while complementing your facility’s energy conservation and sustainability efforts. There are no out-of-pocket costs, since fees to install hardware, support software provisioning and enable data measurement & verification (M&V) are typically covered by DR program earnings.

By giving you near real-time visibility and analytics of your energy consumption, enhanced metering techniques provide more earnings and savings via greater control over your DR participation and greater awareness of electricity usage patterns (remember kW vs kWh!)