PJM Performance Testing Changes – FAQ

In 2023, PJM is planning changes to the Capacity Performance demand response program to better validate the availability of resources to respond to events, year-round.

Here are the key things to know, and answers to questions you might have:

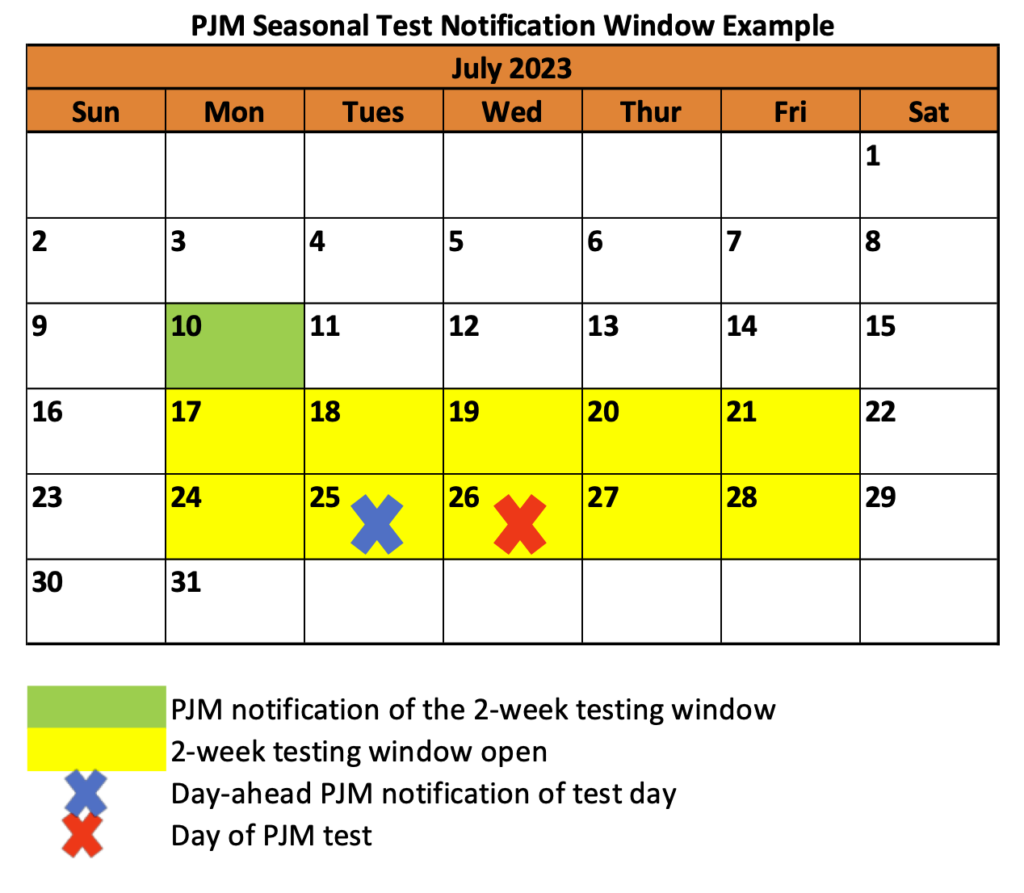

- PJM will now decide when the performance test will be called. Previously, CPower and other DR providers were able to schedule the in-season performance test in advance. PJM will give CPower a week’s advance notice of the 2-week window that a test will be called, and a Day-Ahead notice of the actual test time. CPower will communicate with your team about when test events are coming with as much advance notice as possible.

- PJM has extended the performance test to 2 hours. Customers will need to keep their load dropped through the duration of the 2-hour test.

- In response to these new requirements, customers will now be paid for the energy they’re returning to the grid during the test based on the hourly Locational Marginal Price (LMP) In the past, energy payments were only provided during actual events.

- PJM will test some capacity zones during the summer and other zones during the winter. All sites within a zone will be tested on the same day and will only be tested once during the power year. It is expected that half of the zones will be tested in the summer and half during the winter. The zones tested in each season will shift from year to year.

- The timing of when your zone is tested may impact the schedule of your demand response payments.

- As in previous years, if actual emergency events are called by PJM, payments will be based off real event performance. If a real event occurs before a test is completed, there will be no test in either season.

Why is PJM doing this?

PJM is strengthening the testing requirements for demand response to meet the changing needs of the grid. As the Capacity Performance program has evolved in recent years, PJM determined that the performance test should more closely resemble an actual emergency event, which would not have as much advance notice and would likely need more than anhour’s duration. These changes to the testing requirements bring the program closer to the testing requirements of other major demand response programs around the country (many of which provide no advance notice beyond what’s required for a real event).

Will we know in advance when our site(s) will be tested?

Yes. PJM will inform CPower a week in advance of the testing window and targeted zones. We will share all this information with your team as soon as it’s available. Additionally, PJM will provide a Day-Ahead notice of a planned test during the window, and the event will be dispatched on the testing day with proper notice, based on your registration lead time. Our team is always standing by to help your team stay ready to perform when called on.

If we are tested in Summer 2023, will we be tested again in the 23/24 Winter? Should we assume we will be tested in the Winter the following year?

No. Your site will only be tested once during the power year (June 23 – May 24), either in the Summer or Winter season. PJM will determine which zones are tested seasonally each year, and it is expected that these zones will change annually. CPower will continue to share what we know about PJM’s testing plans as we learn them.

What happens if we are unable to perform for the entire test period?

Your performance for the event will be averaged across the entire 2-hour test duration.

Our site is only enrolled to perform during the summer (or winter), will we always be tested during that season?

Yes. For those sites that are only seasonally available, you will only be tested during your performance season. If PJM is testing your zone in the off-season for your facility, CPower will schedule a separate performance test for your site.

If our site performs poorly, can we retest?

Our ability to re-test depends on the overall performance of all sites in a zone. As always, if your team is concerned about performance, please contact CPower for help.

When will we get paid for our participation in the program?

Customer payments for performance will begin in the quarter following settlement with PJM for measured test performance. This may vary from previous years, depending on when PJM schedules tests. Further detail in the below chart. If you have questions or concerns about how this impacts your organization, please contact the CPower team.

For each Program Period, customers will receive payment according to the table below. All payments are contingent on CPower’s receipt of payment from PJM.

| PJM Test or Event Month | Payment for Q1 | Payment for Q2 | Payment for Q3 | Payment for Q4 |

| June | October | January | April | July |

| July | October | January | April | July |

| August | November | January | April | July |

| September | January | January | April | July |

| October | January | January | April | July |

| November | February | February | April | July |

| December | March | March | April | July |

| January | April | April | April | July |

| February | May | May | May | July |

| March | June | June | June | July |

| April (event only) | July | July | July | July |

| May (event only) | August | August | August | August |

Notes:

- The PJM test will occur between June 1 and March 31 in each Program Year

- The PJM test will be sometime between the hours of 11 am and 6 pm EPT

New England Utilities Keep Demand Response Simple and Sustainable

The model for New England electric utilities launching demand response programs in recent years has followed the time-honored and familiar KISS acronym.

The keep-it-simple approach–paying participants a flat rate per kW curtailed–has worked for the popular Connected Solutions demand response program, which New England Utilities National Grid, Eversource, and Unitil have successfully deployed since 2019 to help lower peak demand on their grids and keep overall costs low for rate paying customers in the commercial and residential sectors.

The success of the program’s simplicity justifies the approach. Look no further than Massachusetts, where an estimated 10% of peak load hours during the year account for roughly 40% of the operating cost of the grid.

Utility demand response programs such as Connected Solutions and others seek to reduce energy usage during these peak times and, in turn, reduce the overall costs of running the grid while keeping electricity rates stable for ratepayers.

The results have been impressive.

According to a December 2021 report by the national nonprofit organization Clean Energy Group, Connected Solutions had about 34,000 residential and commercial participants with 310 megawatts of capacity enrolled by the end of 2020.

In Volume III of CPower’s State of Demand Side Energy Management in North America, National Grid senior engineer Paul Wassink referred to the current state of utility demand response programs as “simple in design, yet effective in achieving results.”

By choosing “simple” as a modifier, Mr. Wassink isn’t slighting his industry’s demand management efforts, he’s merely pointing out that most utilities execute their demand response programs on peak days in order to reduce peak usage.

But it’s when he points to the future that Mr. Wassink hints that simple may not be enough to manage year-round peaks on an ever-evolving grid.

“To attain the future we all desire,” Mr. Wassink has said, “utilities will need to add new demand response programs to help balance the grid every day of the year.”

This notion brings us to the last “S” of the KISS acronym. It doesn’t stand for what you think it does.

The last “S” in the case of utility demand response programs of the future stands for Sustainable.

That means adding more utility demand response programs that not only strategically attack peak usage days but also allow distributed energy resources (DERs) to participate.

Enter the Daily Dispatch demand response program which seeks to help New England Utilities further reduce peaks on their distribution grids.

Offered by New England utilities National Grid, Eversource, and Unitil, the Daily Dispatch program is designed to allow energy storage (batteries and thermal storage) to participate due to the resource’s ability to be dispatched quickly and frequently in response to rising peaks.

For utilities that offer both programs, Daily Dispatch complements the Connected Solutions program, providing an additional non-wires solution to reduce secondary peaks on the grid.

Other New England states and utilities are following suit and introducing demand response programs of their own.

One such state is Maine, which launched a new demand response program in March 2022 managed by the Efficiency Maine Trust and available to customers of the Central Maine Power and Versant Power electric utilities.

The Demand Management Program (DMP) seeks to increase the efficiency of energy use in Maine by deploying measures and strategies such as demand response that mitigate the impact of peak demand on utilities’ transmission and distribution (T&D) systems.

The program also seeks to balance the increased penetration of intermittent renewables such as wind and solar on the grid.

The DMP will consist of two discrete initiatives: The Demand Response Initiative (DRI) is a traditional capacity curtailment program where commercial and industrial (C&I) participants are compensated for reducing their electricity usage when called upon to do so.

The Load Shifting Initiative (LSI) is focused on using both passive and active load-shifting strategies across fleets of devices, including energy storage installed by residential and small business customers.

While the DRI program was approved for 2022, the LSI was not but likely will be in 2023. LSI’s approval and launch will give Maine utilities a one-two punch against peak demand with a traditional demand response program plus one that allows storage participation, similar to the solution other New England utilities wield with Connected Solutions and Daily Dispatch. With the initial launch of the DRI program, we are turning our attention to supporting development of a robust battery program in conjunction with Efficiency Maine Trust.

Many of the New England utility demand response programs can be combined with programs offered by the region’s grid operator, ISO-NE, including the Active Demand Capacity Resource Program (ADCR).

By participating in both utility demand response programs and ISO-NE programs, organizations can earn significantly more revenue for helping the New England grid stay reliable and evolve to a cleaner, more dependable future.

Simple and sustainable.

New England utilities have a plan for using demand response programs to bridge from the grid of the past and present to the dependable and more sustainable grid of the future.

With each participating customer that signs on, the region blows a collective KISS goodbye to grid instability, high operating costs, and unstable electricity rates.

PJM’s Grid of the Future Includes Renewables and Lucrative Ancillary Services

In late February 2022, PJM’s Vice President of Planning, Ken Seller, gave an interview detailing the RTO’s new interconnection process for energy projects. The process aims to establish a better, faster, and more efficient system that will help individual states in the PJM region reach their climate goals.

Just over two months later on April 27, 2022, PJM released a twelve-page perspective for its grid of the future, a vision for how that more evolved system will take shape in the nation’s largest energy market.

By examining the two items published by PJM, we begin to see how the RTO plans to ready its grid for the future. Looking at the current state of PJM’s energy market, it seems clear that ancillary services will play a big role in getting there.

Wind, solar, and storage resources are growing in PJM.

To say there are a lot of renewable energy projects knocking at PJM’s door would be an understatement.

According to Mr. Seller, PJM is currently reviewing more than 2,500 projects with a total of 225,000 MW of capacity, 95% of which is renewable.

To put that in perspective, the roughly 213,000 MW of renewable capacity that PJM currently has under review is more than the current capacity of the entire PJM grid.

In order to achieve the public policy goals of the states in the region, PJM estimates that more than 100,000 MW of renewable generation will need to be interconnected to the grid.

Those estimates break down by resource as follows:

Wind: 18-35,000 MW

Solar: 25-55,000 MW

Storage: 2-7,000 MW

In describing PJM’s energy transition plan, Mr. Seller indicates that the RTO is prioritizing more than 1,200 new projects, most of which are renewable in nature and represent 100,000 MW of nameplate capacity.

Solar has been the most dominant resource in the PJM queue, with projects in the works in all of the RTO’s zones. The recent growth of solar in PJM has led to the subsequent growth of energy storage projects in PJM.

Onshore wind development continues along the Allegheny Mountains. PJM has stated that its initial studies of offshore wind indicate transmission grid enhancements will be needed to accommodate the interconnection of renewable resources.

With renewable penetration comes the intermittency issues inherently associated with key resources such as wind and solar which are dependent on Mother Nature.

Just as Mother Nature giveth with the wind and sun, she can taketh away by not blowing or shining. She can also unleash damaging storms with grid-threatening conditions as PJM dealt with during the Polar Vortex of 2014 when 22% of the grid’s capacity was forced offline.

Devastating storms (Texas 2021) and heatwaves (California 2020) have wreaked havoc on grids throughout the country. PJM’s ancillary services may just serve as a hedge against calamity should Mother Nature throw a major storm the region’s way in 2022 or 2023.

Synchronous Reserves to the Rescue

Synchronous Reserves are load resources that can quickly come online if generated or offline if reduced via demand response within 10 minutes and help PJM balance the electrical grid in the event of an unexpected loss in power generation.

Right now, PJM’s Synchronous Reserves Program is paying considerably more than it has in years to organizations that can quickly reduce their electric loads when the grid is stressed or electricity prices are high.

As of March 2022, PJM’s Synchronous Reserve Market Clearing Price (SRMCP) boasts a monthly average that is more than $1,200 per MW than it was a year ago and nearly $3000 MW higher than it was in 2020.

The upward trending prices in the Synchronous Reserve market come at a time when prices in PJM’s capacity market (the Reliability Pricing Model) are trending in the opposite direction.

The 2022/2023 PJM capacity auction, called the Base Residual Auction, produced a price of $50/MW-day for much of the PJM footprint, a price that was roughly 64% lower than it was following the previous year’s auction.

PJM can’t control the prices in the synchronous or capacity markets, but the grid operator certainly benefits from the currently high SRMCP as it is bound to attract commercial and industrial participants who can quickly shed electric loads when called to help balance the grid and will receive significant revenue for doing so.

The extra load by way of demand response is sure to come in handy on the road to the future grid whether PJM is rocked by a storm or not since there will certainly be cloudy, windless days that affect the output of the region’s solar and wind resources on days when demand on the grid is high.

Looking Forward to Sustainable Reliability

Based on the current work plan, the effective date of PJM’s transition would be, according to VP of Planning Ken Seller, the fourth quarter of 2022 or the first quarter of 2023.

There is plenty of work to be done on PJM’s part until then.

The road to a greener, cleaner, more reliable, and efficient future grid in PJM is sure to be paved with studies, proposals, hearings, submissions, and process enhancements.

If that road to tomorrow includes a few bad (or worse) weather days along the way, PJM can take comfort in knowing their rainy day fund is flush with synchronous reserves resources from organizations that stand to be well-rewarded for helping the grid when called.

What the Latest Capacity Auction in PJM Means for Reliability and Demand Response

On June 21, 2022, PJM Interconnection announced the successful procurement of resources in its annual capacity auction–the Base Residual Auction (BRA)–to meet electricity needs and ensure reliable service for the 2023/2024 Delivery Year.

In a press release summarizing the BRA, PJM explains that the latest auction results reflect “a reliable and lower-carbon resource mix that consumers achieve at a low cost.”

Capacity prices for the 2023/2024 Delivery Year were lower than in the previous auction for the 2022/2023 Delivery Year.

As a result, sufficient resources plus robust reserve levels were procured at the cost of $2.2 billion, compared with approximately $4 billion for the current 2022/2023 Delivery Year.

Why are capacity prices low in PJM?

The first thing to understand when examining the cause of low prices in the BRA is the fact that PJM’s current load forecasts are low. The load forecast is the main driver in the direction of capacity prices.

The grid operator is basing its forecasts on two driving factors: 1) recent overall demand reduction and 2) load serving entities (LSEs) removing their load from PJM’s RPM and instead electing to seek procurement themselves via Fixed Resource Requirement (FRR).

When load forecasts are low, as they are in PJM, the highest-priced capacity resources offered into the Base Residual Auction often fail to clear, resulting in overall prices dropping.

Other factors in PJM have also contributed to already low capacity prices being pushed even lower:

- The Market Seller Offer Cap (MSOC) ruling prevented high-priced sell offers.

- The adjusted Minimum Offer Price Rule (MOPR) allowed a greater amount of resources to offer into the BRA at or near the price of zero.

- Several coal plants retired, taking with them a high-priced resource that was replaced with cheaper nuclear and natural gas resources.

- Cheap energy efficiency resources–i.e. permanently reduced demand–cleared the auction, more so than in previous auctions.

To put it simply, PJM has covered its load forecast with cheap resources, which is a win for both PJM and the organizations in the region.

The grid operator has procured the necessary capacity resources to ensure reliability and it’s done so at low capacity prices

When capacity prices are lower, organizations will see lower capacity charges on their electric bills.

How do low capacity prices affect participants in PJM’s Capacity Performance demand response (DR) program?

While low capacity prices mean lower DR earnings per kW of curtailed load, they also mean more reliability for PJM since the grid operator has the required capacity to meet projected demand.

This, in turn, means the likelihood of a large-scale demand response event is greatly reduced. Organizations participating in PJM’s Capacity Performance (CP) will still be paid for the successful completion of a yearly test, albeit at the established price at which their DR commitment cleared in the corresponding BRA.

Though lower capacity prices may impact Emergency Capacity revenue, it provides opportunities in the following areas:

- Higher Synch Reserve Pricing trend

- Higher Economic Pricing Trend

- Lower incentive to peak shave/lower demand charge create opportunity to not peak shave and increase Emergency Capacity revenues with less operational

It’s worth noting that smaller, localized transmission issues can still cause DR events but large-scale reliability issues do not appear to be in the forecast.

To take advantage of these new opportunities, click HERE to contact CPower for additional review of these options, or a reference to our EnerWise platform.

Related: PJM’s Grid of the Future Includes Renewables and Lucrative Ancillary Services

Three Reasons Your DER Strategy Isn’t Working Like You Planned (and how you can be creating more value)

The electric grid is amidst a transition to a cleaner more dependable and sustainable future. Today, the grid needs flexible resources many organizations currently possesses to complete that transition. These Distributed Energy Resources (DERs) include: energy storage, generation, demand response, energy efficiency and many more. The solution sounds simple, implement DERs, help the grid, improve sustainability and lower energy costs. But for most, this far more complex that it sounds. Join us for this 30-minute webinar to learn the four reasons that your DER strategy may not be working like you planned. It’s never too late to create or adjust a strategy that saves resources, drives better resilience and grid reliability, more cost savings and a predictable revenue stream.

Watch now to learn these four common errors and what you can do to get your strategy on track for success through site-level optimization, automation, and holistic energy management.

Key Takeaways/Learning Objectives:

What is driving the Grid and DER evolution

The four most common reasons DER strategies don’t deliver

How to start improving your DER and Energy Management strategy today

How to maximize the value of your assets

Presenters:

Rob Windle, Executive Director, Distributed Resources

Mr. Windle directs his energies to expanding the monetization of distributed energy resources (DERs) such as decentralized energy generation and battery storage. DERs allow energy consumers to generate financial cost offsets and revenue benefits from increased energy markets participation while leveraging existing and planned systems infrastructure and assets. Previously, He has more than 20 years of experience in direct and channel sales, channel program development, and management within the Energy, Enterprise Software, and Automation Controls industries. Mr. Windle is a Certified Energy Manager and serves as a board member of the Technology Association of Georgia’s Smart Energy Solutions group. He received his Bachelor of Science degree in Industrial

Engineering from the University of Cincinnati. Mr. Windle and his wife live in Atlanta, Georgia.

Millie Knowlton, Sr. Manager, Strategy & Business Development

Millie is the senior manager of strategy and business development at CPower Energy Management, a leading national energy solutions provider. In her role, Knowlton leads new product development and commercialization. Prior to CPower, Knowlton spent four years at Tesla working in commercial energy storage, grid services, and project development. Knowlton has a master’s degree in Environmental Change and Management from the University of Oxford.

APS Peak Rewards for Education (Webinar)

The APS Peak Solutions demand response program offers schools, colleges, and universities the opportunity to reduce their electrical energy use during periods of high usage during the summer and rewards them with revenue payments. The education sector has the opportunity to help promote clean energy for all and receive financial incentives for participation that can be used toward energy or other organizational initiatives.

Reduce energy use, earn revenue, and support grid reliability.

Watch the brief ~30 minute discussion between CPower Energy Management and Osborn Elementary School District and learn:

- More about the Peak Solutions program and how to participate

- Energy reduction strategies for education that help mitigate staff and student disruption

- How much you can earn for participation

- The APS and CPower team that will support your performance

Double Your Money for Demand Response in 2021

Join Kellen Bollettino from CPower Energy Management and Paul Smith with the Ohio Schools Council for this 60-minute webinar and learn:

- Demand Response and Capacity Performance 101 – what you need to know before you start

- How demand response promotes revenue, reliability, and sustainability

- Earning Potential in 2021, 2022 & 2023

- How to participate based on districts energy usage

- How to stack CP, Energy Efficiency Incentives and DR revenues for more value