ERCOT’s Arsenal for Grid Defense (Video)

Demand Response Programs in Texas (Video)

COVID-19’s Impact on the Texas Energy Market (Video)

State of the 2020 Texas Energy Market (Webinar)

In recent years, Texas’s energy market has been put to the test with shrinking reserve margins, increased electrical demand, and grid-threatening heat waves. The ERCOT grid has held and the market has helped organizations in the Lone Star State earn significant revenue by monetizing distributed energy resources.

The Covid-19 pandemic of 2020, however, has unleashed a Texas-sized helping of uncertainty across the state, causing organizations like yours to scramble for energy insights needed to optimize your energy use and spend.

The one-hour webinar is designed to give your organization the demand-side energy management insights you need to make the most of 2020 and beyond in Texas.

Topics to be covered include:

- How ERCOT’s economic-driven market design differs from other US energy markets (and why that design may be better for your organization’s bottom line)

- Why renewable energy is growing in Texas

- How organizations with distributed generation resources can earn revenue

- Lucrative demand response opportunities in Texas

- And more…

CPower’s Texas experts Mike Hourihan and Joe Hayden host this webinar that includes a question and answer session.

Download the slides from this webinar as a pdf here.

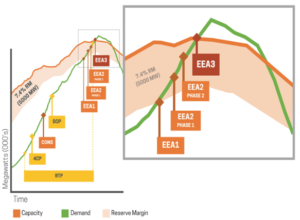

ERCOT’s Effective and Lucrative Last Bastion Against Blackouts

Texans love a good fight, especially if there is a lot riding on the outcome and the battle comes down to the wire only to be won in the waning seconds by the last fighter standing.

Maybe that’s why ERCOT’s Load Resource demand response program has been a favorite of commercial organizations in the Lone Star state over the last few years.

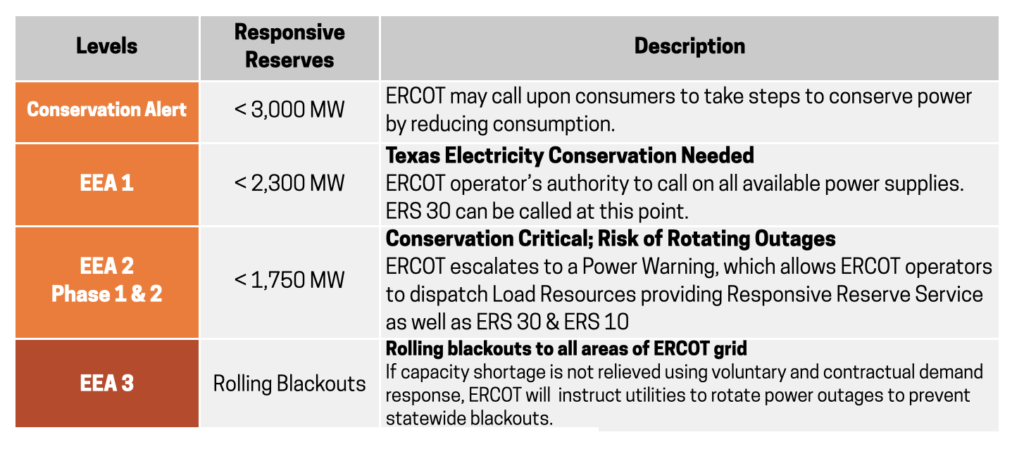

As we’ve discussed in a previous article on the ERCOT’s protocols for demand-side resources, dispatching Load Resource is the grid operator’s last line of defense before initiating rolling blackouts.

Load Resource has consistently been ERCOT’s most rewarding demand response program. Look no further than 2019 for proof.

In 2019, a year which saw ERCOT call its first demand response events in half a decade, the program not only paid extremely well, but participants were never called to curtail their loads.

In the demand response events on August 13th and 15th of 2019, grid balance was restored before Load Resources were needed. Still, Load Resource participants earned revenue 1) for being available to curtail and 2) because of the spike in real-time pricing that reached $9,000/MWh.

The year Load Resource had in 2019 embodies how economic drivers of the Texas energy market are working to keep the grid reliable, demand response participants happy, and electricity rates relatively low for ratepayers.

What kind of year will 2020 be for Load Resource?

Predicting the future is usually a fool’s errand, especially when it comes to the energy industry. But let’s give it a shot anyway.

Electric demand continues to rise in Texas and ERCOT has taken measures to keep its grid reliable. The reserve margin is growing and a new demand response program (ERCOT Contingency Reserve Service or ECRS) will eventually be added to the ISO’s arsenal in 2024.

But if we look at the last five years, Load Resource has been called a grand total of zero times. All the while, participants have earned significant revenue for being available to help the Texas electrical grid if needed.

Sometimes the past helps predict the future. In that case, it looks like 2020 will be another strong year for Load Resource in Texas.

This is, after all, 2020. The summer of the wildest year we can remember isn’t over yet. But the Texas grid has been up for the fight so far this year. If the last few rounds get particularly punishing, Load Resource is standing guard as the grid’s lucrative last bastion.

To learn more about ERCOT’s Load Resource program as well as the state of the energy market in Texas, join CPower’s Joe Hayden and Mike Hourihan on September 3, 2020 (changed from Aug 27 in response to Hurricane Laura), for a 60-minute webinar: The State of Demand-Side Energy Management in Texas for 2020. Register HERE.

SOTM 2020 Webinar Series

The Future of Demand Response in Texas (Webinar)

Download the slides from this webinar (PDF)

Bouncing Back From 2020 in Texas’s Resilient Energy Market

2020 … what a year we’ve had in ERCOT so far! Oil and gas prices have dropped to near-record lows. COVID-19 has driven massive energy usage declines across the world while rebalancing load demand in ERCOT as many organizations shift to work-from-home environments.

Through it all, ERCOT has maintained a very tight reserve margin while adjusting its energy policy. But, as always, Texas’s energy market design has proven to be up to the challenge.

The question, however, for most commercial and industrial energy managers is “what does all this mean for my organization’s energy strategy now and in the future?”

The good news is CPower has kept its finger on the pulse of these important topics and is ready to help your organization better plan, prepare, and implement your energy strategy for success … so you don’t have to.

Join us for this 60-minute webinar to learn:

- The changes and updates in the ERCOT energy market

- Energy programs in ERCOT that deliver revenue to help offset costs (or losses)

- A deep-dive into ERCOT’s Load Resource (LR) and Emergency Response Services (ERS) demand response programs

- The changes and opportunities on the horizon for energy consumers in Texas

Led by Mike Hourihan, Director of Market Development in the ERCOT market, and Joe Hayden, General Manager, ERCOT with CPower. The webinar will also have a live Q&A session to answer all of your demand-side energy management questions.

CPower Experts Share Insights Into North America’s Energy Markets in 2020 (Webinar)

Watch the latest webinar from CPower and SED

Why the Demand Response Events in August 2019 Affirm Texas’s Market Design

It was hot in Texas on August 13 last year. Real hot. Nolan-Ryan-fastball-under-your-chin-hot. Roasting-armadillos-on-the-driveway-hot. Electric demand across the state predictably spiked. Voluntary (i.e. non-incentivized) calls to curtail issued by ERCOT went largely unanswered. (Would you volunteer to shut your A/C off when it’s 103 ̊ F?)

Then, at 3:10 pm ERCOT dispatched its first wave of demand response. The event lasted less than two hours. Balance was restored to the grid. All was well. So what makes Texas’s market superior (at least in the mind of Texans) to other regions that feature capacity markets? Two reasons:

- By not having to bolster a capacity market, Texan ratepayers don’t have the inflated electricity bills lamented by consumers hailing from markets that procure more capacity than needed.

- By having an economic trigger whereby the wholesale price of electricity in times of scarcity surges to $9,000/MWh, Texas provides an irresistible incentive for organizations to help the grid in times of need.

In short, the Texas energy market is driven by economics not regulation.

As a result, the market’s demand response resources are robust. Why shouldn’t they be? Event calls are few and far between and participants are cashing in when called upon by the grid.

Exactly the opposite is happening in California, where participants who are already paying high electricity rates are fatigued from the number of demand response calls they’ve received over the years. They’re not being rewarded much for their curtailed megawatts, either. Capacity prices in the Golden State dipped below the national average years ago and have been stuck there ever since.

The economic-driven design of the Texas energy market doesn’t just incentivize emergency capacity in times of need. When it comes to integrating distributed energy resources (DERs) onto its grid, economics are leading the way in the Lone Star State.

This post was excerpted from the 2020 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

ERCOT Establishes the Covid-19 Electricity Relief Program – Market Minute (Video)

On March 26, 2020, the Public Utility Commission of Texas (PUCT) established the COVID-19 Electricity Relief Program, providing eligible residential ratepayers in the state with a temporary exemption from disconnections due to non-payment of electricity bills.

According to the PUCT’s draft of the Order, the program is to be funded by a rider implemented by Transmission and Distribution Utilities (TDUs).

The rider will collect funds to be utilized to reimburse TDUs and REPs for unpaid bills from eligible residential customers experiencing unemployment due to the impacts of COVID-19 and to ensure continuity of electric service for those residential customers.

All customer classes are obligated to pay this charge. The initial rider will be based on $0.33 per megawatt-hour (MWh).

The rider will have an immediate effective date upon being implemented by the TDU.

It’s not known at this time how long the charge will exist. In its Order, the PUCT has reserved the right to supplement and/or modify the relief program by a subsequent order.

This is something we’re monitoring closely, so check back with The Current or sign up to learn more as it happens.