Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

Peak-shaving, essentially the practice of an organization reducing its demand during times of peak grid stress to lower its capacity charges, is part of what the Federal Energy Regulatory Commission is considering as the agency examines PJM’s annual capacity construct.

In a June 2018 proposal, PJM stated it hoped to reduce its capacity market demand curve by including peak shaving among the variables it considers when developing its load forecast.

To do this, PJM would have to adjust its current forecasting model, which involves identifying gross load for a delivery year and establishing a forecast that includes economic, weather, and end-user changes, but excludes peak shaving as a variable.

PJM believes their proposed model will provide a more holistic view of the grid and its potential need for resources to maintain the balance between supply and demand.

Opponents are concerned whether PJM’s proposed methods for integrating peak shaving as a variable in forecasting its load are underdeveloped and will ultimately provide an accurate forecast.

They may have a point.

PJM’s proposal states among its outstanding issues that accounting for existing peak shaving activity relies on entities providing PJM with historical peak shaving activity and that currently there is no established best practice for obtaining this crucial data.

Is Peak Shaving Right for Your Organization?

Given all this uncertainty around peak-shaving in PJM, it’s a fair question to ask if the practice is right for your organization.

Since no two organizations are alike, the answer to that question will naturally vary from one organization to the next.

Consider that an organization involved in peak shaving will likely curtail for about 30 hours in a single summer in an attempt to time their curtailment with the hours PJM’s grid is at peak system load.

Is the organization better off curtailing for that long and realizing the savings in subsequent peak charges? Or would the organization be better off participating in demand response, which, if not called for an emergency event, only involves just one test hour during the summer?

It’s best for a given organization to consult a licensed curtailment service provider that has the ability to evaluate all of an organization’s energy assets and explain how they may best be leveraged in PJM’s existing markets to optimize savings and earnings through demand-side energy management.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

In our last ERCOT blog post, we laid out the record high demand/historically low supply scenario facing ERCOT and its customers this summer. As we reported, ERCOT acknowledges that this situation could result in emergency energy alerts. This will more than likely result in high electricity prices, perhaps record high prices. If you participate in ERCOT’s Load Resource (LR) demand response program, those high prices will mean generous revenue paid to you for participating in LR.

In the rush to enroll in LR and capitalize on some Texas-sized payouts before the summer enrollment deadline, though, a lot of commercial and industrial customers have encountered an unexpected ERCOT roadblock: UFR. And they want to know: What’s a UFR? What’s it got to do with LR DR? Why do I need it? And how do I get it?

To answer these questions and get everyone on the path to significant summer revenue, we have to start with dirty power.

Dirty power is a term used to describe electricity that is affected by abnormalities such as power surges, excessive line noise, and fluctuating frequency. It usually describes power intended for delivery through the electrical grid, and that’s how we’ll use it here. It can have several causes, but the end result is almost always the same: damage to your equipment and infrastructure that can cripple your daily operations.

You probably don’t think of electrical power as “dirty.” It’s hard to imagine, perhaps because you can’t see, smell or touch it. You can see, touch or smell dirty water and dirty air. Same with work clothes, office windows, and motor oil.

But electric power can in fact be “clean” or “dirty.” Unlike the examples above, though, dirty power stays dirty. You can’t clean it, at least not easily. The abnormalities that make it “dirty” are usually generated at the source and can flow to the farthest reaches of the grid almost instantly.

Wind is a major source of dirty power. Ironically, it’s also the current centerpiece of Texas’s nation-leading embrace of “clean” renewable energy. The Lone Star State’s drive to incorporate more renewable energy sources to power the grid has established Texas as the largest producer of wind power in the U.S. ERCOT says wind accounted for 17.4 percent of electricity generated in its service area (roughly 90 percent of Texas) in 2017.

But this intermittent source of power generation is also a major source of “harmonics” — a distortion of the underlying sinusoid of a signal, referred to as over or under frequency events. That’s dirty power. West Texas, where there are a lot of wind generators, is dramatically affected by frequency changes. As the wind increases or decreases, the generation created by wind turbines flows onto and off the grid, causing frequency changes as the load drops and rises. At the least, these frequencies can cause overheating and premature equipment failure.

That brings us to UFR. UFR stands for Under Frequency Relay. According to IEEE, UFRs are used to automatically shed a certain amount of load whenever the system frequency falls below an acceptable level for grid stability. Think of it as an industrial-strength circuit breaker that protects the grid — and your business — from shorting out.

So, why does ERCOT require that LR participants have UFRs installed? Because UFRs help them fulfill their mission to maintain the security and reliability of the ERCOT system. That includes helping the grid stabilize autonomously by stopping the spread of Under Frequency.

As the number of wind turbines dotting the windswept Texas plains has increased, so has the possibility of frequent under frequency conditions. So has the need to stop the spread of UFR throughout the grid. (The oil and gas communities across West Texas were among the first to adopt UFRs in the fields, largely to protect their machinery.)

To do that, they need you. Customers that can meet certain performance requirements can be qualified to provide operating reserves as a Load Resource and be eligible for a capacity payment. In short, LR DR. And that requires that an Under Frequency Relay be installed that opens the load feeder breaker on automatic detection of an under frequency condition.

As we noted above, dirty power can spread easily and rapidly across the state and affect every organization attached to the grid, especially commercial and industrial concerns. And we also noted that to be considered a Load Resource and receive capacity payments, you have to be available as needed. A great way to knock out an available Load Resource is dirty power in the form of an under-frequency condition. UFRs assure that your availability will not be affected by this particularly spreadable form of dirty power.

If you want to enroll in LR and don’t have a UFR, CPower can help. We work with world-class third-party resource vendors and partners who can design and install UFRs to the exact specifications of the CPower curtailment plan developed for your facility. By working with the best, we assure you of the best opportunity to save and earn.

You don’t need a UFR to go about your daily business. But you do need it to receive the financial benefits of being a Load Resource available to provide invaluable operating reserves as needed. Considering that the growth of renewables, especially wind, shows no signs of abating in Texas, and with it the threat of under frequency conditions, having a UFR might just be a good idea, period.

UPDATE March 5: ERCOT announced today that, due to expected record high demand and “historically low” 7.4% expected reserve margin, they have “identified a potential need to call an energy [emergency] alert at various times this summer.” (Emphasis ours.) Alerts allow ERCOT to take advantage of resources available only during scarcity conditions—particularly demand response. ERCOT will release its final summer report in May.

Two significant factors projected for ERCOT — the Electric Reliability Council of Texas—stand to have a noticeable impact on its energy market: Reduced supply and record peak demand. The resulting clash between these two market drivers point to the very real possibility of unexpectedly high prices for organizations participating in ERCOT’s Load Resources (LR) demand response program. Let’s take a look at what’s driving these two important factors, and how this could translate into an opportunity to generate revenue through demand response.

Reserves have dropped dramatically. Since mid-2017, ERCOT has approved the retiring of four coal-fired generation plants responsible for generating more than 4,500 MW in capacity. It’s not just coal generation, though. Since the May 2018 Capacity, Demand, and Reserves (CDR) report, three planned gas-fired projects totaling 1,763 MW and five wind projects totaling 1,069 MW have been canceled. Another 2,485 MW of gas, wind and solar projects have been delayed.

In its December 2018 CDR report, ERCOT projected total available generation capacity for Summer 2019 at 78,555 MWs—an estimate, as it turns out, that’s too low. ERCOT recently learned that it is losing another 470 MWs from the Gibbons Creek coal plant going offline this summer. That drops reserve capacity to 78,085 MWs—a low, low 7.4% reserve margin, just over half of the long-standing target margin of 13.75% of peak electricity demand.

And demand will peak. Last year, ERCOT set an all-time peak demand record of 73,473 MWs on July 19 between 4 and 5 p.m. This year, ERCOT predicts more “record-breaking peak demand usage” for the summer: 74,853 MWs, 1300 MWs higher than last year’s all-time peak.

That leaves a gap of—hold on—just 3,232 MWs. Low supply. High demand. Tight, tight margins. All that adds up to the potential for record high prices in ERCOT’s Load Resources (LR) ancillary services demand response program that ERCOT deploys to maintain sufficient operating reserves.

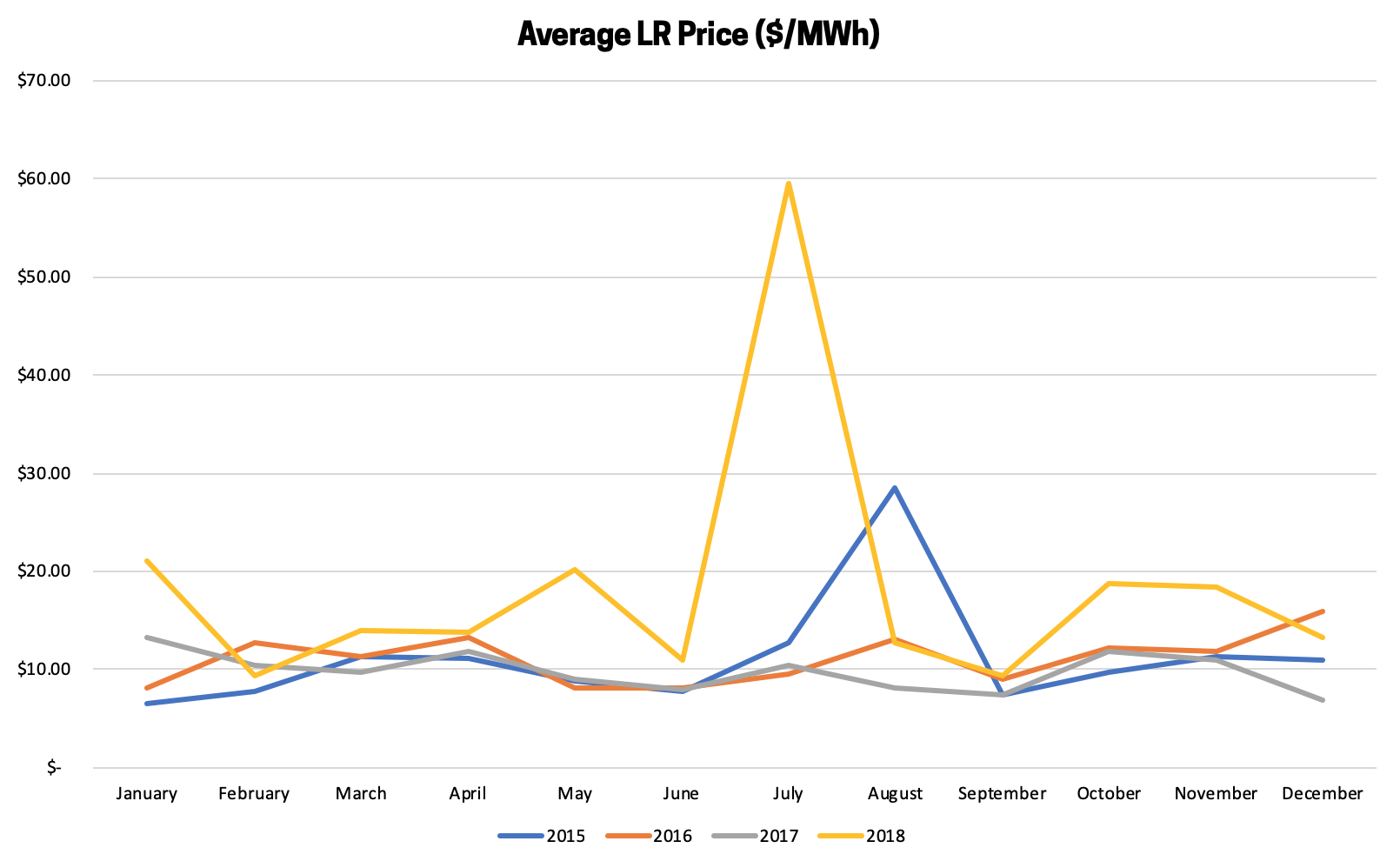

Already, LR prices have increased since the retiring of 4,200 MWs of generation in 2018. (see chart.) Additionally, projected wholesale energy prices in ERCOT for Summer 2019 are some of the highest we have seen. It’s not a stretch to anticipate high, if not record high, LR prices this summer.

High prices in Load Resources mean generous revenue paid to you for your participation in the program which pays businesses for being available to curtail energy on short notice when the grid is stressed. LR has the potential to pay organizations two to three times more than other ERCOT demand response programs.

CPower can help you get the most out of the Load Resources program by working closely with your organization to develop a customized curtailment strategy, including automation, that suits your business objectives and operational considerations. Start the conversation today. Learn how to maximize your curtailment revenue with CPower and ERCOT’s LR program.

Distributed Energy Resources (DER), including storage, are proliferating the world of energy management in a big way. Today, these assets are primarily implemented to provide operational resilience and demand management; however, additional opportunities are rapidly evolving.

As intelligent application of DER assets increases for commercial and government sectors, the opportunity to leverage these same assets into revenue generating channels also increases.

Through programs like demand response, your DER assets become vehicles for saving and earning, which increases ROI, shortens project payback periods or helps fund other energy projects, all while providing greater support for grid reliability.

Join DER and storage experts from CPower Energy Management and Stem and learn about:

The clock has started ticking down on backup generators in California’s demand response programs. On January 1, 2019, the California Public Utilities Commission’s Demand Response Prohibited Resources decision officially takes effect. The decision (officially Decision 16-09-056) mandates that fossil-fueled resources can no longer be used to provide demand response.

The decision doesn’t remove fossil fuel generators from use for backup or for facility power generation, just from demand response (DR). It’s clear, though, that they face near-certain elimination from the California power landscape in the near future. The historic green energy bill signed by Gov. Jerry Brown on September 10th, 2018, specifically requires that 50 percent of California’s electricity be powered by renewable resources by 2026—seven short years away.

Needless to say, this has some profound implications for the future of distributed energy resources (DERs) and DR in the nation’s most populous state (and the world’s fifth largest economy). California’s “bold path” toward 100 percent zero-carbon electricity by 2045 will take it through uncharted territory potentially full of threats to the reliability of its far-flung electrical grid and the costs of the electricity it provides.

Demand response in California, as elsewhere in the country, has been a valuable tool in managing demand-side energy use, protecting the grid, and funding progressive sustainability initiatives. Generators have been a valuable part of DR, providing additional opportunities to save and earn as part of their commitment to a balanced California grid. But California has long been strict on the use of non-emergency generation for demand response, and the green energy bill tightens restrictions to an outright ban.

With fossil-fuel generators permanently pulled from DR participation in California, then, the question facing participants is, “Now what?” There are no easy answers—in a constantly evolving energy universe like California’s, there never are. That said, CPower recommends a couple of steps you can take to ease your transition into a post-fossil fuel world and continue to save and earn.

No Generators? No Problem.

The 2015 court ruling that vacated the EPA’s rule—referred to in the industry as “the Vacatur”—took effect in 2016 and upended DR participation. Hundreds of fossil-fuel backup generators were withdrawn from DR programs in most of the nation’s wholesale energy markets

One water agency, though, found they could still successfully participate in DR without their generators. Virginia’s Lake Gaston Water Supply Pipeline supplies water to Virginia Beach, the state’s most populous city. The Vacatur forced them to withdraw their diesel-powered generators from their DR program. Without the generator to sustain pumping during curtailment as part of DR, they faced the prospect of not being able to curtail the required power during an event, which meant pulling out of DR completely.

Working with CPower, Lake Gaston’s curtailment service provider since 2010, managers were able to research new methods of DR participation without generators. These measures included a full pump shutdown, something they weren’t sure they could do successfully. After a thorough analysis and review of their operations with CPower, it turned out that they could. Read the full story here.

Back to Basics

Before you mourn kilowatts lost, take a moment and consider if there are kilowatts to be found to replace them. Start by asking yourself, “What’s changed since I received my first demand response check?” The answer might be, “Everything,” or something close to it.

How have your day-to-day operations changed in response to changing market conditions? What upgrades have you made to your lighting, HVAC, IT, security, and communications? Is your physical space smaller or bigger? Have you added locations? What’s the state of your building envelope? Is it sufficiently insulated? Has on-site staffing grown or declined?

These are questions to be answered when you have a knowledgeable energy engineer, like those at CPower, conduct a thorough assessment of your facility. Your new “deep dive” assessment forms the foundation for creating a new curtailment action plan, one that matches your available kilowatts to available demand response and demand-side energy management programs. Chances are you’ll find new kilowatts to replace those lost from removed generators, and possibly more.

Dollars for DERs

Now is the perfect time to think beyond the generator and embrace other dispatchable distributed energy resources, or DERs, for your backup power. Behind-the-meter technology like storage batteries—charged by renewable but intermittent resources like sun and wind as well as grid energy—can be enrolled by CPower in California’s demand response programs (Capacity Bidding Program, Base Interruptible Program, and Demand Response Auction Mechanism aka DRAM) as available generation to help when the grid is stressed. You can combine your DER asset with demand response programs to offset kWs lost from generators.

For example: California State University, Dominguez Hills is one of the most sustainability-focused campuses in the state system. In 2017, CSUDH joined with CPower and Stem, provider of the school’s 1 MW intelligent storage system, to create a combined curtailment and storage program. By stacking these technologies, CSUDH significantly reduced their environmental footprint, provided approximately 400 kW of grid relief, and generated revenue that flows back to the school to fund further sustainability initiatives. For their efforts, CSU was also recognized with the 2018 Smart Energy Decisions Innovation Award for Customer Project/Onsite Renewable Energy.

What’s Next?

As California moves toward 100% zero-carbon energy, it’s safe to say that fossil-fuel generation, on both the micro and macro level, will continue to be phased out. Demand response, however, will continue to have an important role in California’s energy re-imagining. Demand response continues to fulfill its primary role, protecting the grid of the world’s fifth largest economy. Look for thought leaders and decision makers to find new and better ways to integrate renewables and dispatchable renewable energy resources into statewide demand-side energy management programs. And look for CPower to continue to advocate on behalf of our customers to ensure their ability to save and earn while protecting the grid.

In this white paper, we’ll explore the various forms that demand-side energy management takes. We’ll look at how one university seized the opportunity to generate significant revenue from demand response participation and succeeded spectacularly. Finally, we’ll examine distributed energy resources and how another university found an innovative way to both optimize their energy program and maximize their revenue with intelligent storage.

Virginia Beach, VA – Faced with the prospect of losing hundreds of thousands of dollars in demand response revenue, this Virginia Beach site discovered a way to keep the money flowing without interruption.

THE CUSTOMER: LAKE GASTON WATER SUPPLY PIPELINE

The Lake Gaston Water Supply Pipeline, also known simply as Lake Gaston, is at the heart of the economic vitality of the City of Virginia Beach (see our City of Virginia Beach case study). Located west of the city, on the North Carolina border, Lake Gaston employs six vertical-turbine centrifugal pumps, each with a nominal capacity of 10 million gallons per day, to supply Virginia Beach with the 30 million-plus gallons of treated drinking water that its residents consume each day. (The high-capacity pumps give the station the flexibility to increase pumping up to 60 million gallons per day.) The water flows through a 76-mile-long pipeline (which includes six overhead river crossings) from the lake to facilities in nearby Norfolk for treatment.

Since 2010, Lake Gaston has participated in the demand response program offered by CPower through Virginia’s Department of Mines, Minerals and Energy (DMME). This program pays government entities market rates for curtailing their electricity usage during times of high demand on the grid. Participants save on their energy costs and earn revenue that can be reinvested in upgrades, energy efficiency projects, and more. Lake Gaston’s participation has earned them nearly half a million dollars since 2011 (see chart below).

Steven Poe, the city’s Water Master Planner, assumed management of Lake Gaston in 2015. At the time, Lake Gaston had already earned more than $221,000 in DR participation, and Steve understood he could count on a continuing and beneficial revenue stream. Unfortunately, he hadn’t counted on a court ruling that dramatically changed the role of emergency generation in demand response.

THE CHALLENGE: CONFRONTING THE VACATUR

In 2013, the federal Environmental Protection Agency (EPA) issued emission standard exemptions that permitted emergency generators to operate up to 100 hours a year for “emergency demand response.” Lawsuits from environmental groups, state governments, and commercial power generation groups challenged the EPA’s ruling, saying it would hurt air quality and grid reliability. In May, 2015, the United States Court of Appeals for the DC Circuit vacated the 100-hour rule (on procedural grounds). This vacating ruling, dubbed “the Vacatur,” would take effect on May 1, 2016.

The Vacatur threatened to have a disastrous impact on Lake Gaston’s DR participation—and earned revenue. Lake Gaston was designed to pump continuously and could not do so without the use of its diesel engine generator.

The Vacatur left Steve no choice but to withdraw his diesel-powered generator from the DR program. Without it, he not only faced loss of revenue from its participation, but potentially the loss of all DR revenue. If the generator could not be used to sustain pumping during curtailment, then Lake Gaston would not be able to curtail the required power during a called event without jeopardizing Virginia Beach’s water supply. The pumps, then, would also have to be pulled from the program, essentially shutting down the lucrative revenue stream.

Or would they?

Steve felt that the financial benefits of DR participation warranted a closer look for a creative solution. “When we realized we couldn’t curtail anymore with our generator, we didn’t want to miss out on the incentives,” he says.

But to reach their target, they would have to conduct a full shutdown. Could they shut the pumps down—and bring them back up—without damaging both pumps and pipelines? And if they could, would that be enough to continue in DR without damaging their savings and earnings?

THE STRATEGY: SHUT ‘EM DOWN

Full shutdowns are rare in nearly all industrial settings, but Lake Gaston had a precedent. In 2014, a 39-ton coal ash spill on one of the lake’s tributaries forced the pump station to shut down for about two months. This was the first extended shutdown of the pump station in its history and caused a great deal of concern. Lake Gaston was designed to maintain a minimum sustainable pumping rate of eight million gallons per day flowing through the pipeline to maintain water quality and prevent issues with start-up. When pumping resumed, Virginia Beach learned that the pipeline was resilient and could recover with minimal effort.

Using that experience, Steve and his team are able to shutdown the major energy consuming equipment at the pump station – including the pumps and industrial HVAC system – within one and a half hours of being notified of a DR event. They’ve learned that participation without their generator is worth the extra effort of executing full shutdown and start up procedures, which requires monitoring the SCADA system and gradual reduction and startup of pumps to prevent water hammer.

THE CPOWERED SOLUTION: DMME + CPOWER DEMAND RESPONSE

Steve and his team had proven that pumps could be shut all the way down and brought all the way back up, on demand, with no damage to pumps and pipelines. He could curtail his assets enough to continue to participate in DR. The question remained, though: Would it be enough? “We were worried,” Steve says, “that if we didn’t cooperate or couldn’t participate in the test or event, there would be a penalty.” That could erase any financial benefit.

Fortunately for Steve, he had Leigh Anne Ratliff, CPower Account Executive, working with him. Leigh Anne has been with DMME since the inception of the joint DR program, and with Lake Gaston since they enrolled in the program in 2010. (She also works extensively with the City of Virginia Beach.) No one is as familiar with the DR program and Lake Gaston’s participation than Leigh Anne.

Leigh Anne told Steve that, because Lake Gaston (and the City of Virginia Beach) participate through DMME’s demand response program, there would be no consequences for not participating in a test or event. “The great thing about the DMME contract with CPower,” Leigh Anne explains, is that you really cannot be penalized. You’ll never owe anything. The worst that can happen is you’ll earn zero dollars for that test or event.”

THE RESULT: $400,000+ AND COUNTING

With penalties off the table and a successful pump shutdown protocol established, Steve continued Lake Gaston’s enrollment in the DMME DR program. He has yet to see zero dollars earned.

“We’re committed to saving money and being good stewards of public resources,” Steve says. “CPower is very supportive and encouraging for us to participate, to meet our commitments. When I first stepped into this position and informed my supervisors about the program, we all thought it was just too good to be true. But it has really worked out, and we are happy to continue participation.”

| Lake Gaston Water Supply Pipeline—Demand Response Earnings | ||

| Delivery year | kWs submitted | Earnings in $ |

| 2010/11 | 1843 | $ 99,676.00 |

| 2011/12 | 1557 | $ 53,311.00 |

| 2012/13 | 1759 | $ 30,685.00 |

| 2013/14 | 620 | $ 10,670.00 |

| 2014/15 | 1548 | $ 27,137.00 |

| 2015/16 | 1661 | $ 61,267.00 |

| 2016/17 | 1337 | $ 24,353.75 |

| 2017/18 | 1340 | $ 44,085.73 |

| 2018/19 | 1258 | $ 58,536.69 |

| Totals to date | 12,923 | $ 409,722.17 |

Data centers are in demand.

The growth of cloud computing and the subsequent challenge of powering big data has led to a data center construction boom.

A 2018 industry profile by Dun & Bradstreet predicts data center space to grow to 1.94 billion square feet worldwide in 2018. Much of the industry’s new construction aims to continue the trend toward energy-efficient buildings, shedding the label of “comatose power drains” issued by the New York Times in a 2012 article that claimed, “data centers can waste 90% or more of the electricity they pull off the grid.”

Since the early 2000’s, data-hosting organizations have sought to discard their profligate reputation by making their buildings more efficient and (if at all possible) environmentally responsible.

While more efficient than their early 21st century iterations, data centers continue to use a lot of electricity–up to 50 times more than standard office spaces—and subsequently face the high expense of large-scale electricity consumption.

Green data centers–those which are environmentally responsible and resource-efficient–aim to lower costs and create a more sustainable operation through improved design and by using more efficient equipment. According to the London-based research organization Technavio, the green data center market is expected to grow at a compound annual rate of about 15% by 2021.

Data hosting organizations that have upgraded their existing facilities to be more energy efficient may be eligible to earn money for the permanent reduction of their electric demand.

That’s because the data center industry’s recent push toward a more efficient and sustainable future comes at a serendipitous time when energy markets around the country are working to reduce demand via energy efficiency investments and to integrate distributed energy resources (DERs) onto their energy grids in an attempt to diversify their fuel mixes.

Right now and for the foreseeable future, grid operators and electric utilities in each of the nation’s six deregulated energy markets have created a wealth of incentive programs to encourage commercial and industrial organizations to invest in energy efficiency and to monetize their generation capacity.

Energy Efficiency: Earn money for permanently reducing demand

Organizations that have recently upgraded their data center facilities by way of installing high-efficiency HVAC equipment, investing in more energy efficient IT technologies, improving airflow or data management and more may be eligible to earn money for their energy-reducing efforts.

Energy Efficiency (EE) is the permanent reduction of electrical demand through the installation of efficient systems, including improvements or upgrades to building infrastructure, mechanical systems, existing equipment or new devices.

In some energy markets in the US (PJM and New England, for example) organizations can earn money for these permanent reductions in demand by partnering with a licensed demand-side management company who can offer these “negawatts” (capacity from conservation rather than power generation) into the Independent System Operator’s (ISO) forward capacity market.

Many electric utilities offer incentives to organizations that have permanently reduced demand through energy efficiency projects. These opportunities create another revenue stream to either decrease project paybacks or allow for reinvestment for future projects.

Demand Response & DERs: earn money for helping the grid

Most data centers are powered by electricity from the grid, which is susceptible to outages due to the demand for energy outpacing the grid’s ability to supply it.

Data centers can’t afford to be down due to a brownout or blackout for a single second, lest they risk losing their customers forever.

The use of on-site power generation is, therefore, a ubiquitous practice amongst data centers. While primarily seen as a reliability resource of paramount importance, a data center’s generation capacity can also be a revenue-generating asset for organizations that participate in demand-side energy management, particularly demand response.

When the grid is stressed and demand for electricity exceeds supply, the grid operator must work to restore the balance.

Instead of calling for the generation of more energy at great expense to consumers and the environment, the grid operator can offset the imbalance by calling on commercial and industrial organizations to reduce the amount of electricity being consumed from the grid when demand exceeds supply.

That’s demand response–programs that pay organizations to reduce electricity usage during times of grid stress or high energy prices.

For data centers with on-site backup generation, earning money through demand response participation is possible without sacrificing service to customers. That’s because a properly permitted backup generator can play a starring role in an energy curtailment strategy that can lead to significant earnings for data centers.

Read to learn more: “Leveraging Your Generation Assets to Generate Revenue”

When selecting a company to guide your demand-side energy management, it’s important to consider the company’s scope of demand-side expertise. Do they serve the markets where your properties reside? Does the company specialize in one type of demand-side energy management, or is it equally skilled in a wide range of energy asset monetization practices?

Most importantly, a demand-side energy management partner should earn your trust in every aspect of the relationship your organizations share.

Demand-side energy management is not a one-size-fits-all exercise. No two buildings are alike and every data center organization is unique in its complexities.

Like your business, your demand-side energy management strategy should evolve and refine over time, forever in pursuit of perfection as energy markets continue to change and your needs as an organization evolve.

Learn more about CPower’s extensive experience in the data industry.

Read the entirety of “Monetizing Energy Assets in the Data Center Industry: A Complete Guide for Earning Revenue with demand-side energy management”.

A complete guide for earning revenue with demand-side energy management

The data center industry’s recent push toward a more efficient and sustainable future comes at a serendipitous time when energy markets around the country are working to reduce demand via energy efficiency investments and to integrate distributed energy resources (DERs) onto their energy grids in an attempt to diversify their fuel mixes.

Data Centers with distributed resources at their facilities like backup generators are in prime position to reap significant financial benefits by working with a properly licensed company that can help them monetize their existing energy assets.

This paper offers a detailed explanation of how a data center can monetize its existing energy assets with demand-side energy management.

programs and practices that comprise it. In this explanation, we’ll take a close look at the evolving energy industry in the US with an emphasis on the growth of DERs and the role they play and will continue to play in North America’s fuel mix of today and tomorrow.