Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

The year is 2040. Grid modernization has seen the integration of large-scale storage and renewables overtake traditional fossil fuel and nuclear generation. Sustainability, grid reliability, and energy technologies have been major drivers for a modern grid structure. Customers have become more connected and engaged with their utilities and drive the utility business model beyond selling kilowatt-hours.

According to the U.S. Department of Energy, an estimated 20-50% of industrial energy input is lost as waste heat.

Many industrial organizations in the U.S. have learned how to recover waste heat, yet few understand how to monetize it.

Industrial waste heat is the energy generated in an industrial process that is not put to practical use. Waste heat sources include hot combustion gases discharged to the atmosphere, heated products exiting industrial processes, and heat transfer from hot equipment surfaces.

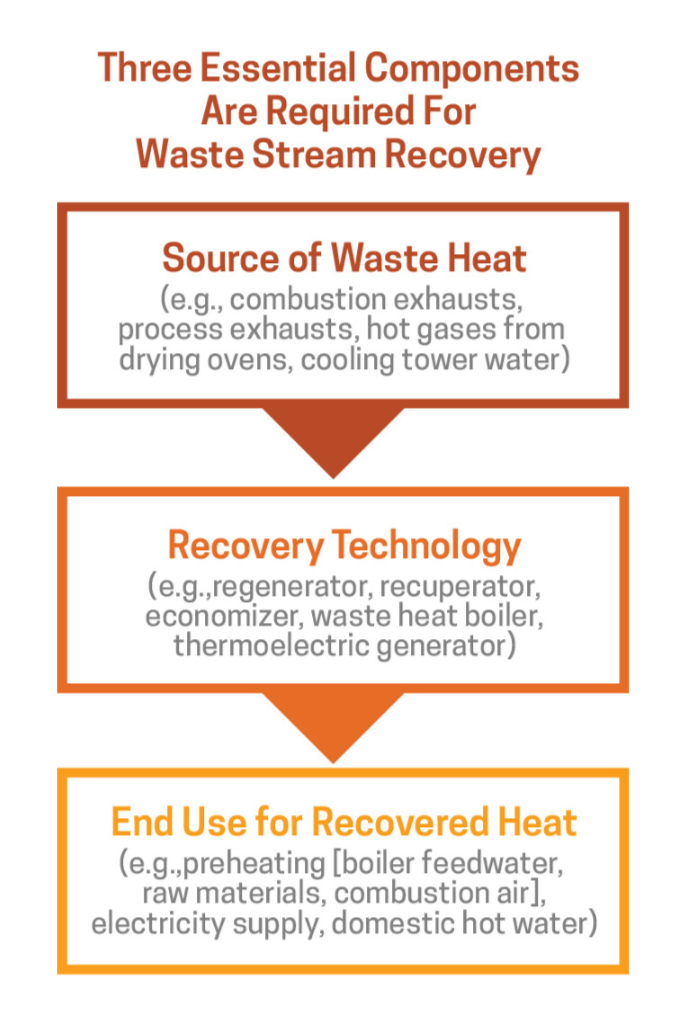

Waste stream recovery involves capturing and reusing waste heat for the purpose of heating or for generating mechanical or electrical work.

Example uses for recovered waste heat include:

Types of industrial manufacturers that are good candidates for waste heat recovery include:

Glass Manufacturing–Regenerators and recuperators are the most frequently used systems for waste heat recovery in the glass industry, which collectively consumes approximately 300 TBtu/year.

Cement Manufacturing–The cement industry consumes about 550 TBtu/year with its most energy-intense processes including those which mine and prepare raw materials for the kiln, clinker, production, and cement milling. Options for heat recovery include preheating meal and power generation (cogeneration).

Iron and Steel Manufacturing–Consuming approximately 1,900 TBtu of energy per year, the U.S. iron and steel industries are prime candidates yet face a challenge for executing economically sound heat recovery. While recovery from clean gaseous streams in these industries is common, heat recovery techniques from dirty gaseous streams (from coke ovens, blast furnaces, basic oxygen furnaces, and electric arc furnaces) often incur high capital investment costs.

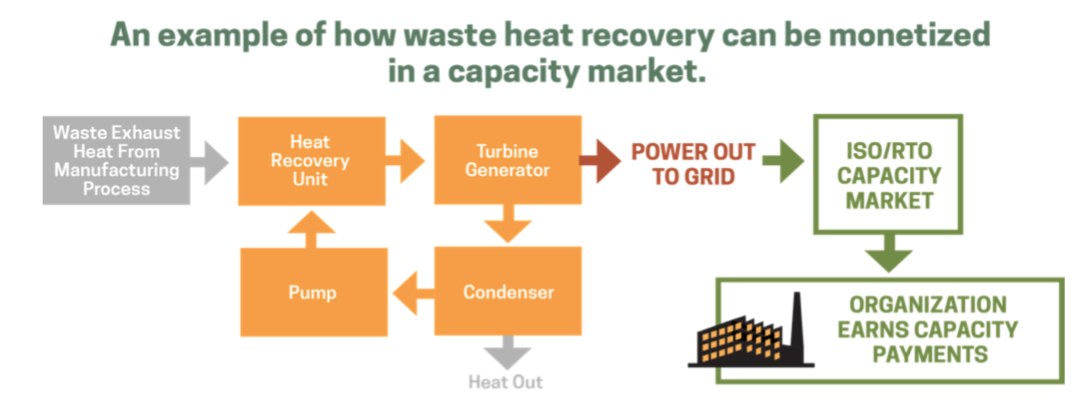

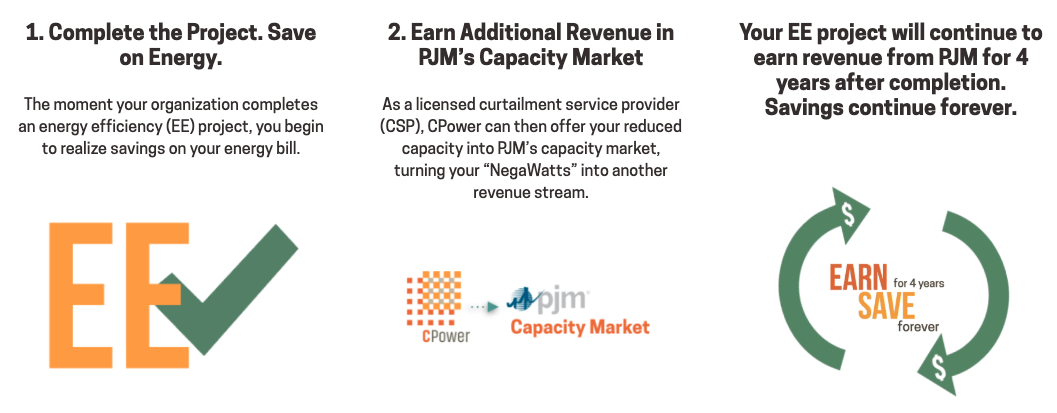

In several deregulated markets in the U.S.–PJM, for example–recovered waste heat can be monetized by offering the recovered resource into the region’s forward capacity market.

Forward capacity markets like PJM’s Reliable Pricing Model (RPM) allow the grid operator to procure the grid’s required capacity in advance of its delivery day.

Implemented in 2007, PJM’s Reliability Pricing Model uses a market approach to obtain the capacity needed to ensure its grid’s reliability.

The RPM’s market approach includes incentives that stimulate investment in existing generation from traditional sources like power plants while encouraging the development of other resources such as demand response and energy efficiency.

In many cases, organizations that are already participating in waste stream recovery can realize easy earnings akin to found money that requires little work to obtain other than offering the recovered resource into the market.

To learn more about monetizing waste stream recovery and how to offset the rising U.S. energy expenditure share, read CPower’s “Demand-Side Energy Management in the U.S. Manufacturing Industrial Sector: an analysis of revenue-generating strategies.”

Uncertainty is the arch-nemesis of business. In planning for 2020, it appears our old foe has the upper hand

Is 2020 a year for your organization to get aggressive and try to expand? Or is it a year to sit tight and see what happens? Maybe it’s time to pull back on the reins.

Chances are, regardless of your organization’s particular industry, the last two and a half to three years have been especially strong from a growth and productivity standpoint.

After all, 2019 marks the tenth straight year of growth for the U.S. economy, and the U.S. GDP has especially boomed since 2016.

So why, then, is planning for 2020 proving to be harder than in previous years?

The short answer: uncertainty. And this year, our old nemesis is back with a vengeance and flanked by his favorite minions: speculation and conjecture.

No one knows for certain what the future holds. No one knows for sure how long the trade tariffs will last. No one knows who’s going to win the 2020 Presidential election. And no one knows for certain where energy prices might be at this time next year.

And yet here we are, looking for any credible insight we can find that will bring the future into focus so we can make the business decisions today that will position us for success tomorrow.

Rather than guess what tomorrow’s landscape might look like, let us instead look at one key fact established by what already has happened to energy in the U.S.

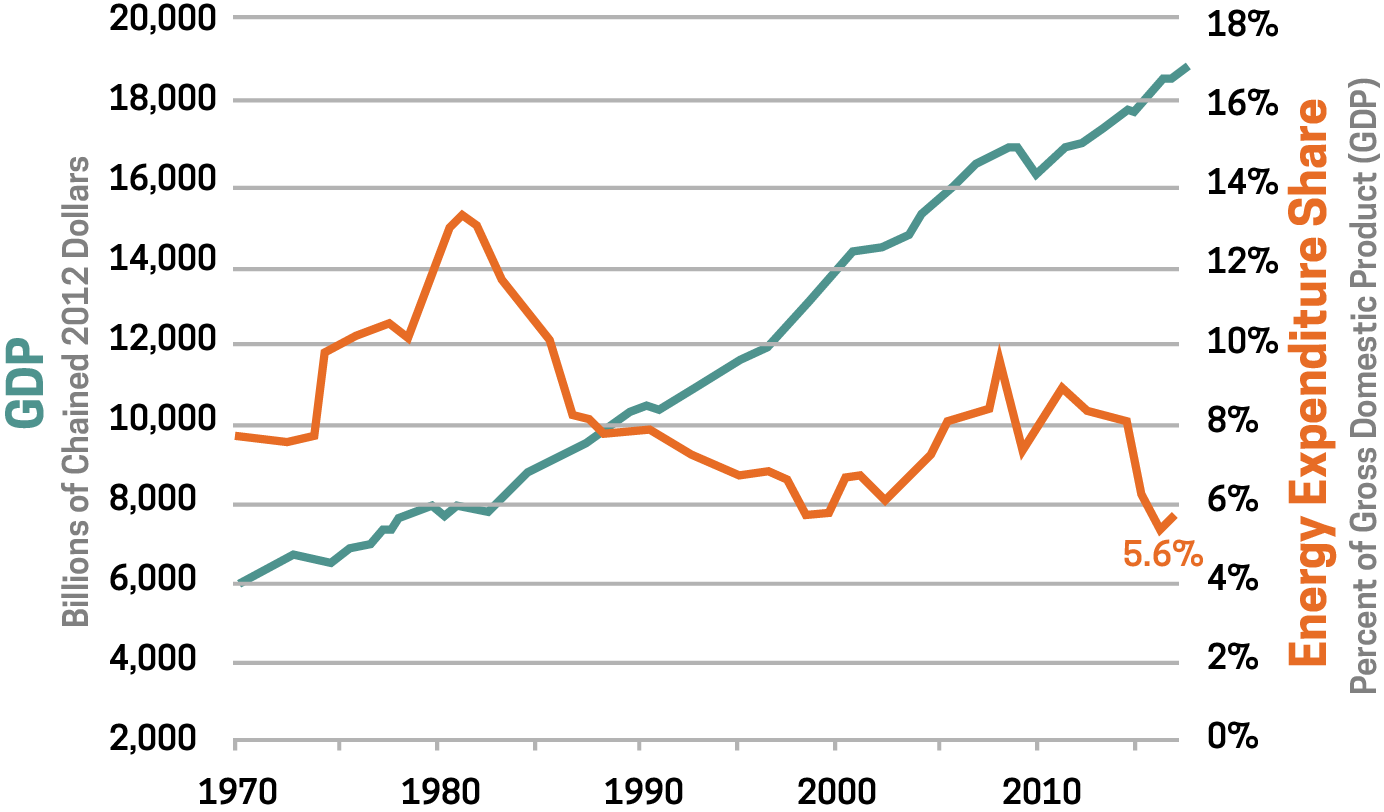

This chart shows the U.S. Gross Domestic Product (GDP) and the US energy expenditure share graphed together over roughly the last 50 years.

The GDP is defined as the total value of goods and services produced in the United States during a specified time.

The U.S. total energy expenditure is defined by the Energy Information Administration (EIA) as the amount of money spent to consume energy in the United States each year.

The energy expenditure share is the total energy expenditure measured as a percentage of the GDP.

Looking at the two graphed together in the chart above, we begin to see a story emerge concerning how well we’ve produced as a country over the last 50 years and how much we’ve spent on energy to achieve that production.

GDP, which does have its down years from time to time, has trended up for just about as long as it’s been measured. The energy expenditure share, on the other hand, has fluctuated wildly over the last half-century.

Consider the 5.6% energy expenditure share that occurred in 2016. That number is significant to everyone in charge of planning for his or her organization’s immediate future.

In 2016, the U.S. energy expenditure share was the lowest it has ever been in the history of the United States of America. Never before had U.S. GDP and energy expenditure share been farther apart than it was just three years ago.

That means, in 2016, the U.S. produced more than we ever had before and spent less on energy as a percentage of that production than at any other time in our country’s history.

The low energy expenditure share isn’t due to a lack of energy consumption in the U.S. The EIA reports the US total energy consumption has remained largely unchanged since 2013.

So why then has our energy expenditure share been so low? The EIA has officially stated the cause is “entirely due to low energy prices,” with abundant, cheap natural gas playing a big role in the overall trend.

Perhaps the better question for businesses to ask is how long is this ideal period going to last?

The short answer is it’s already over.

The EIA has reported that since 2016, average energy prices of motor gasoline, natural gas, and retail electricity have all increased, resulting in higher U.S. energy expenditures in 2017 (5.8%), the last year for which the data is available.

So what’s going to happen to energy prices in 2020? The Energy Information Administration thinks they’ll likely rise. Exactly how much is hard to say.

What this means, however, is that if your organization does everything exactly as it did during the boom of 2016-2017, your results in 2020 won’t be as strong, simply because you’ll have spent more on energy to achieve the same amount of productivity.

There’s an old saying about making hay while the sun shines. When conditions are right for what you do…do it. In the past few years, conditions in the U.S. have never been more right to produce. But those conditions have shifted.

Organizations that understand the nature of that shift as it relates to their energy use and spends are less likely to succumb to uncertainty and the paralysis it can induce when planning for the future.

Optimal productivity is your goal. If uncertainty is the villain standing between your organization and its objectives, then improved demand-side energy management may be the ally you need to help you get to the other side.

To learn more about how to offset the rising U.S. energy expenditure share, read CPower’s “Demand-Side Energy Management in the U.S. Manufacturing Industrial Sector: an analysis of revenue-generating strategies.“

One of the Reforming Energy Vision’s primary goals includes renewable sources generating 70% of the state’s electricity by 2030. To do that, the New York grid seeks to implement distributed energy resources into its fuel mix.

How might New York’s energy market be redesigned to incorporate DERs like solar, energy storage, and others?

NYISO’s proposed changes meet opposition

In 2018, the NYISO proposed changes to the ICAP Capacity Market for how long a resource must be able to run to be eligible to be paid the full value of capacity.

Using the results of a study on energy-limited resources by GE Consulting (GE), the NYISO initially proposed that resources would need to be able to run for 8-hours in order to obtain full capacity value. The NYSIO then proposed it would allow resources that can perform for shorter durations to be paid a fractional portion of the capacity value as follows:

8-hrs=100%

6-hrs = 75%

4-hrs = 50%,

2-hrs =25%

A group of demand response and energy storage providers, including CPower, challenged the GE study’s findings.

A formal review of the GE study by Astrapé Consulting revealed “several flaws in the assumptions and methodology that influenced the study results to show a decreased capacity value for shorter-duration resources than would likely be expected.”

Skepticism of the GE study’s results quickly spread among key New York energy stakeholders, including DR providers, energy storage developers, C&I customers, environmental groups and various trade associations.

These stakeholders submitted a joint letter to the NYISO executive team and board of directors requesting “all market design changes relating to the GE Study results (including any changes to the SCR program) be removed from the DER Roadmap.”

So where does that leave New York?

Potential changes in the New York Energy Market

While there is an ongoing debate about the future of New York’s capacity market, there are no major regulations or market design changes yet announced to take effect in 2019. That could change pending the outcome of an April vote (more than a month away as of this writing) among New York’s energy stakeholders.

That means, for example, the Special Case Resource (SCR) demand response program will continue to operate under its current parameters, including a four-hour duration requirement.

As far as the DER wholesale market goes, New York is in wait-and-see mode. DERs, especially battery storage, and renewable energy sources are a key component of the REV’s drive toward New York’s energy future.

New York, like several other US energy markets, is faced with the question of how to value distributed energy resources in its marketplace.

The question of DER valuation is being debated by the NYISO and various energy stakeholders in the state. As of this writing, there is no definitive timetable for when the debate will conclude and regulations for DER valuation will be enacted.

Energy Storage

New York has taken its place alongside California, New Jersey, and Massachusetts as a first-mover in establishing energy storage targets.

In June 2018, Governor Cuomo announced an energy storage roadmap that set New York’s storage target for 1,500 MW by 2025. According to the roadmap, that ambitious goal could elevate to 3,000 MW by 2030.

At the state level, New York has recognized the need to fund storage projects instead of subsidizing them. Last June, Governor Cuomo committed $200 million from the New York Green Bank to fund storage investments that will help integrate renewable energy onto New York’s grid.

Funding opportunities for storage abound with plenty of state money being made available for storage development.

But without certainty on the wholesale market side and established rules concerning dual participation between markets, meeting the state’s ambitious storage goals will continue to have its challenges.

The key energy players in New York will need to resolve these issues before any substantial investment from the private sector will take a position on energy storage. The NYISO is targeting April 17, 2019, for a vote on market design to accommodate DER integration into its wholesale markets.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.